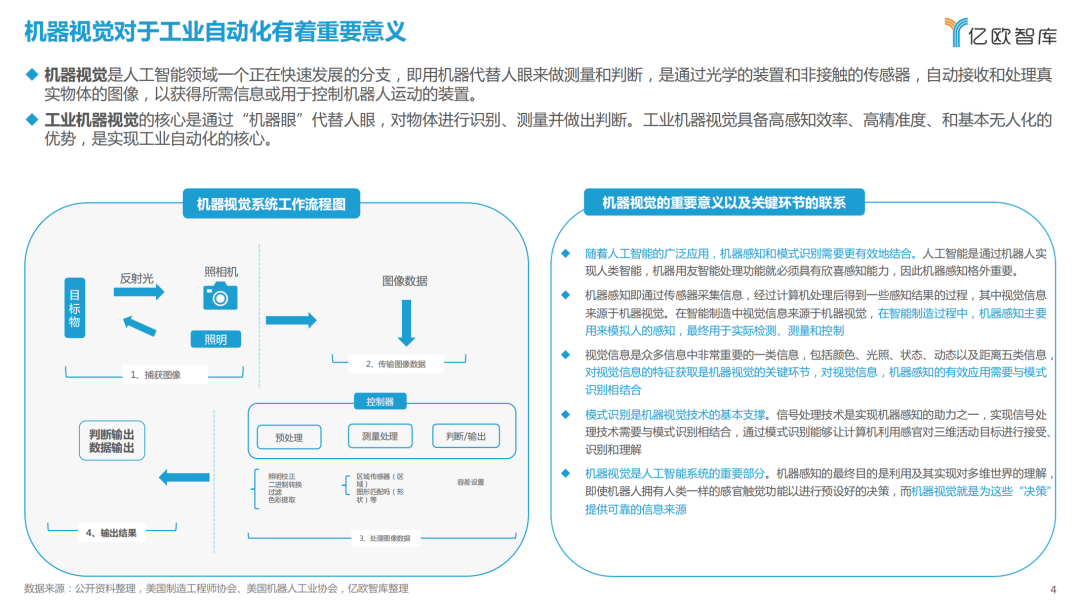

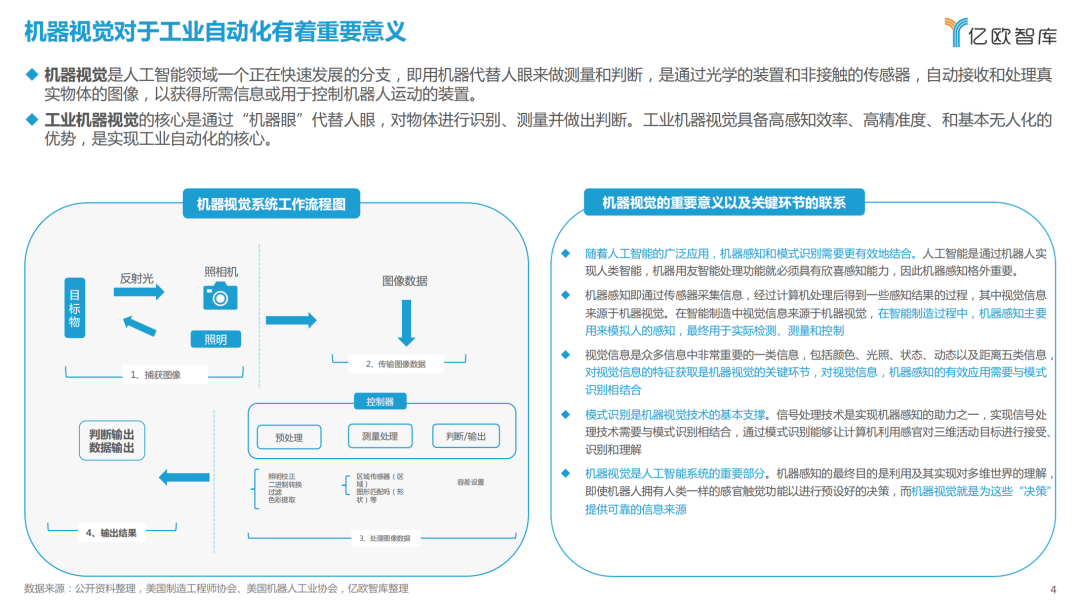

Machine vision is a rapidly developing branch in the field of artificial intelligence, which uses machines to replace the human eye for measurement and judgment. It is a device that automatically receives and processes images of real objects through optical devices and non-contact sensors, in order to obtain the required information or to control the movement of robots.

The current market development status of the machine vision industry

Machine vision is of great significance for industrial automation

Machine vision is a rapidly developing branch in the field of artificial intelligence, which uses machines to replace the human eye for measurement and judgment. It is a device that automatically receives and processes images of real objects through optical devices and non-contact sensors, in order to obtain the required information or to control the movement of robots.

The core of industrial machine vision is to use the "machine eye" instead of the human eye to recognize, measure, and make judgments on objects. Industrial machine vision has the advantages of high perceptual efficiency, high precision, and basic unmanned operation, and is the core of achieving industrial automation.

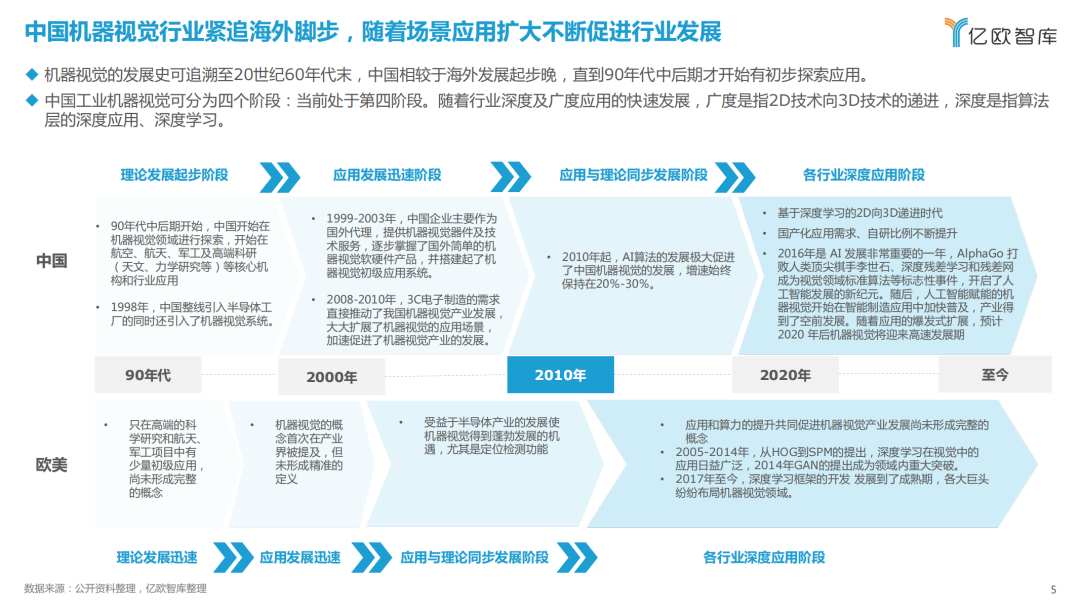

The Chinese machine vision industry is keeping up with overseas footsteps and continuously promoting industry development with the expansion of scene applications

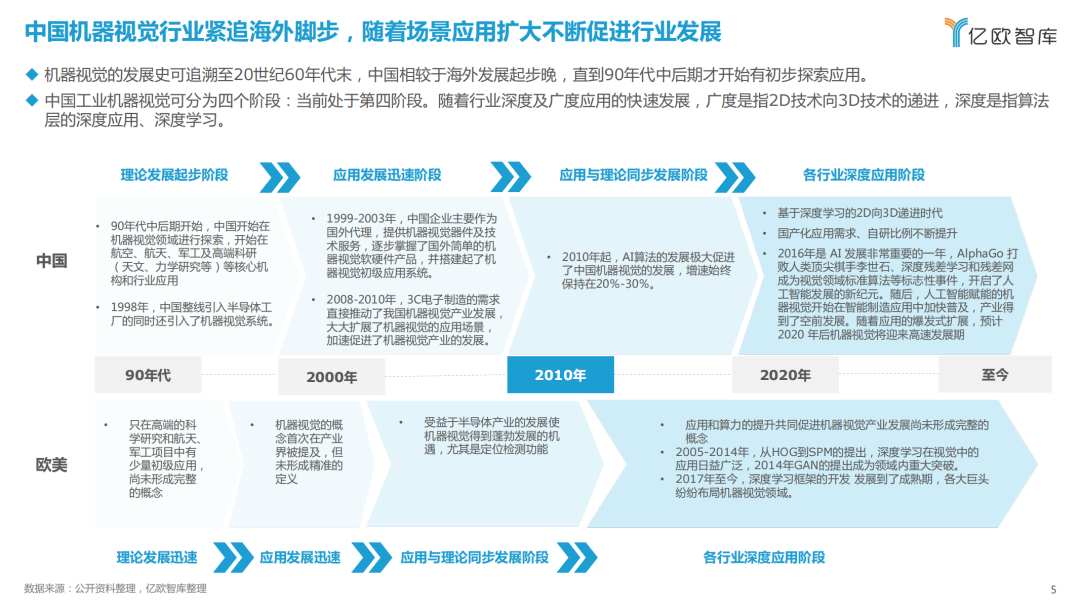

The development history of machine vision can be traced back to the late 1960s. China started relatively late compared to overseas development, and it was not until the mid to late 1990s that preliminary exploration and application began.

Chinese industrial machine vision can be divided into four stages: currently in the fourth stage. With the rapid development of industry depth and breadth applications, breadth refers to the progression of 2D technology to 3D technology, and depth refers to the deep application and deep learning of algorithm layers.

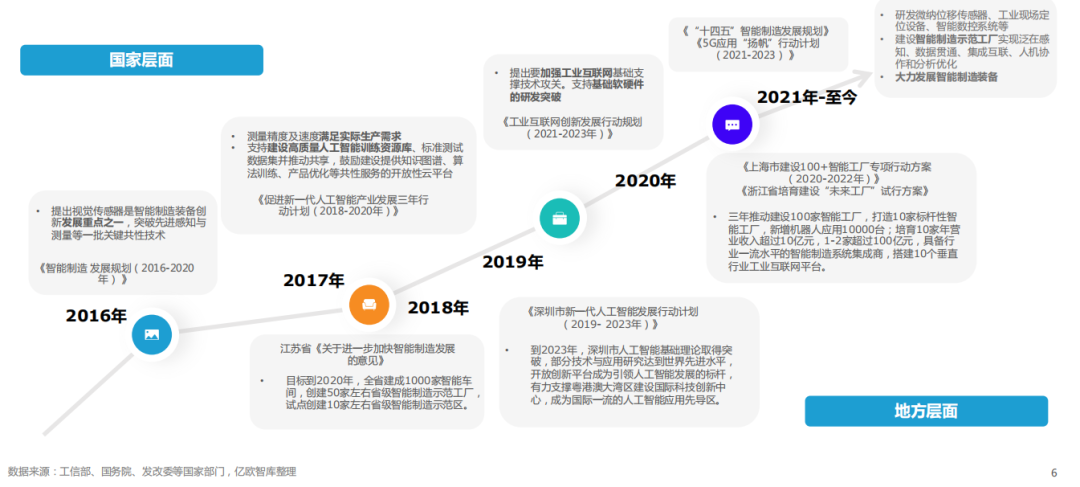

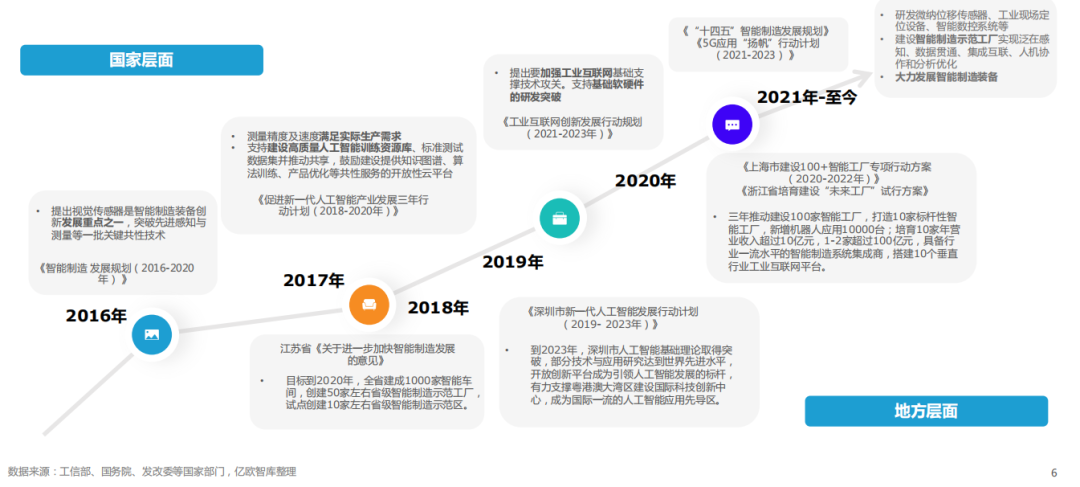

Policy support at the national and local levels plays a strong role in promoting the development of industrial machine vision

From a national policy perspective, machine vision, as a new generation of perception technology, takes root with its inherent advantages and flourishes with the help of favorable macro and policy environments. From the perspective of local policies, during the 14th Five Year Plan period, various provinces and cities in China have proposed development goals for the machine vision industry. The relevant policies to promote the construction of intelligent factories are mostly concentrated in the Jiangsu, Zhejiang, and Shanghai regions, and the large-scale production of intelligent robots is laid out. The policies that drive the development of machine vision are mostly in Beijing, Guangdong, and other places.

As the most mature field, the demand for localization in industrial vision will further promote the rapid development of industrial vision in China

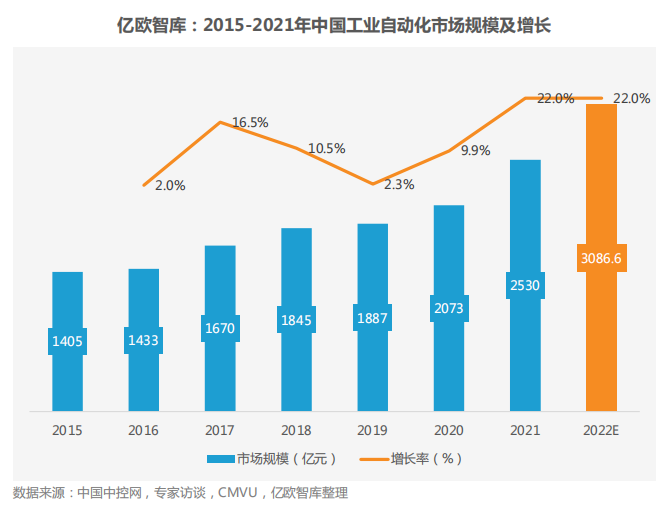

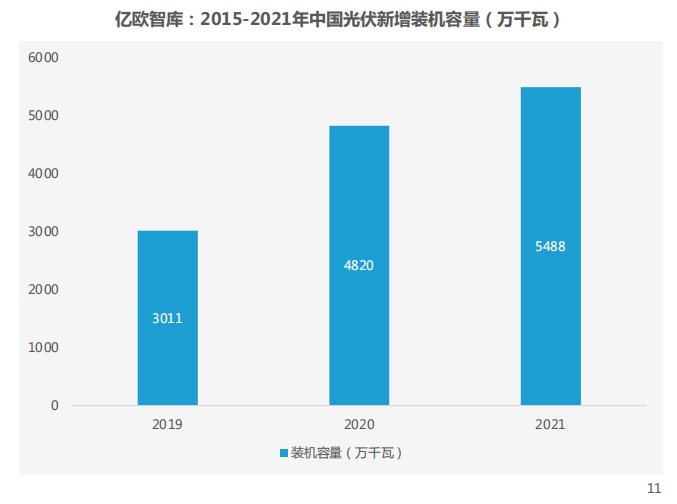

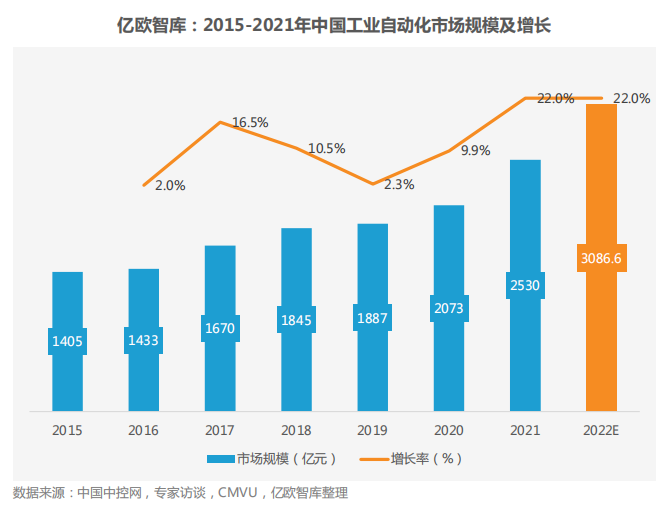

The current potential market demand for machine vision in China is enormous, with a wide range of application needs. The scale of the industrial automation market is also expanding year by year. Data shows that from 2015 to 2020, the scale of industrial automation increased from 140.5 billion yuan to 207.3 billion yuan. In 2021, the scale of China's automation and industrial control market has also increased to 253 billion yuan, a year-on-year increase of 22%.

Machine vision software and hardware technology continues to make breakthroughs, and visual products with industrial cameras, image capture cards, light sources, and image processing software as the core are becoming increasingly sophisticated. The cost is also continuing to decline, promoting the accelerated development of industrial vision level.

The process of localization is accelerating, and the proportion of sales of independent products continues to increase. The proportion of independently developed products is constantly expanding. From 2019 to 2021, the sales revenue of independent products increased from 8.59 billion yuan to 13.47 billion yuan, with a CAGR of 25.2%. The current domestic machine vision market is mainly concentrated in the 2D technology field, and over 80% of the market share in the 3D technology field is still occupied by foreign enterprises.

The upstream of the machine vision industry chain is mainly focused on cameras, lenses, etc., the midstream is mainly focused on system integrators, and the downstream is mainly focused on industry applications

From the perspective of the machine vision industry chain, the links in the industry chain are relatively long. The upstream is composed of machine vision system hardware and software algorithms, while the midstream is mainly responsible for software secondary development and equipment manufacturing for equipment manufacturers and system integrators. The downstream application scenarios and industries are broad. The current industry with high application heat is concentrated in industries such as 3C electronics, lithium batteries, photovoltaics, and semiconductors.

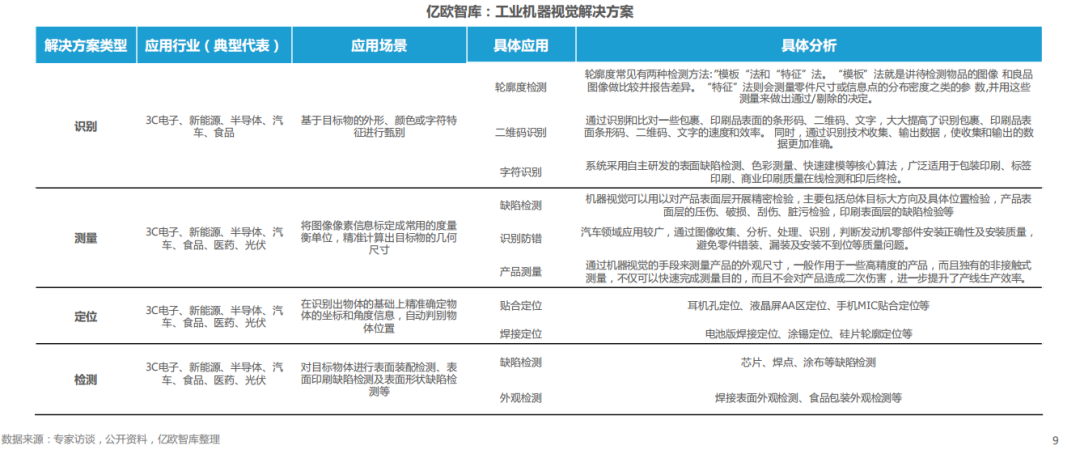

The application boundaries of the four major machine vision solutions in various industry scenarios are gradually becoming blurred

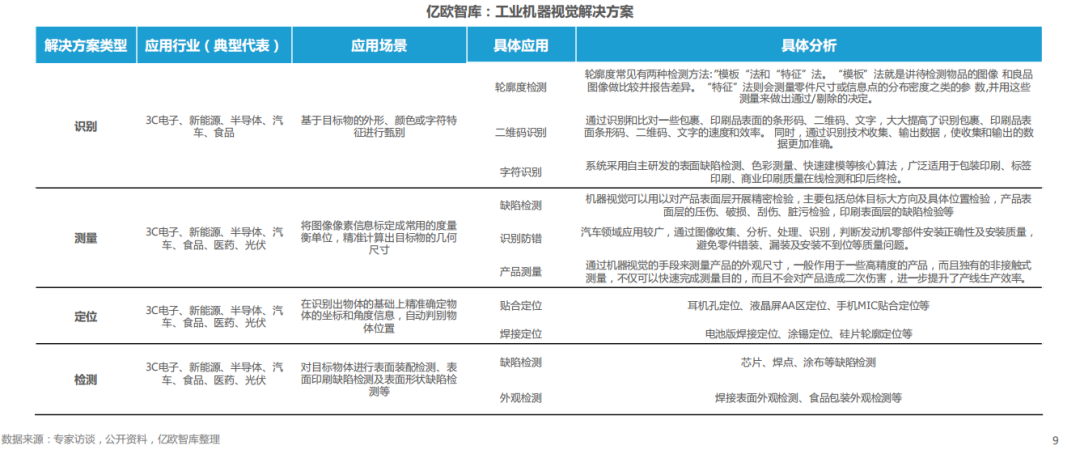

The scene applications of industrial machine vision can be divided into recognition, measurement, positioning, and detection functions. At present, the most commonly used scenarios are visual detection and visual guidance.

Due to the fragmented application scenarios of industrial machine vision, there are multiple and repetitive characteristics in the application of scenes in production and manufacturing. Yiou Think Tank believes that due to the blurred boundaries of various application scenarios of industrial machine vision, industrial machine vision is divided into four major solution types here. Currently, machine vision mainly involves industries such as 3C electronics, lithium batteries, photovoltaics, warehousing and logistics, healthcare, heavy industry and metal processing, light industry, automotive and semiconductor, etc.

In 2022, the size of China's machine vision market will exceed 20 billion yuan, with industry being the most important application field

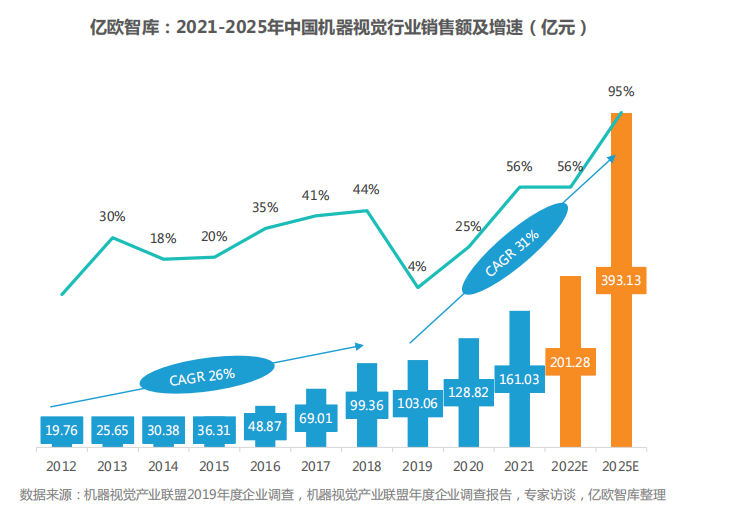

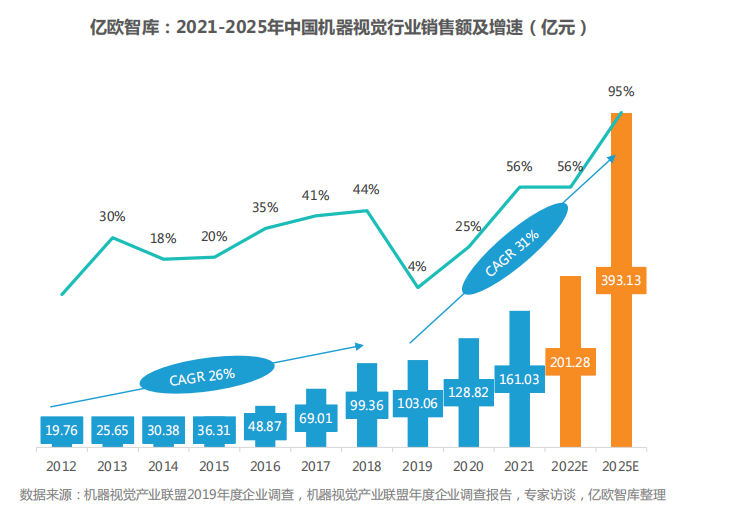

According to the survey results, the sales of machine vision devices and systems in China increased from 1.98 billion yuan in 2012 to 16.1 billion yuan in 2021, with a compound growth rate of approximately 31.7%, and the growth rate of 56% in 2021 was particularly significant. The sales revenue of China's machine vision industry is expected to exceed 20 billion yuan in 2022. Yiou Think Tank believes that it is due to the rapid development of the concept of AI vision. In traditional machine vision, domestic substitution is gradually expanding market share.

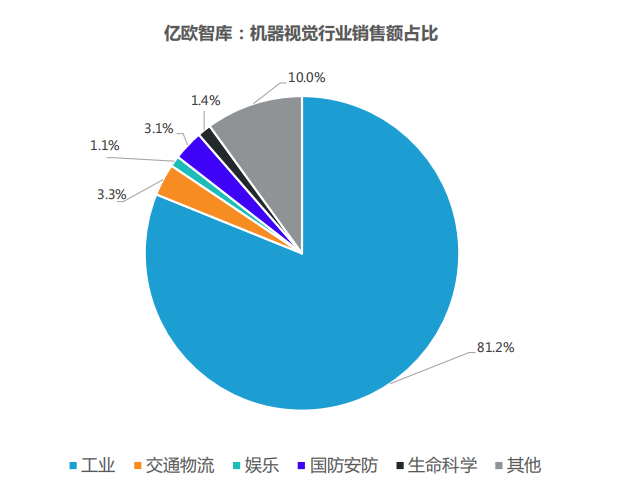

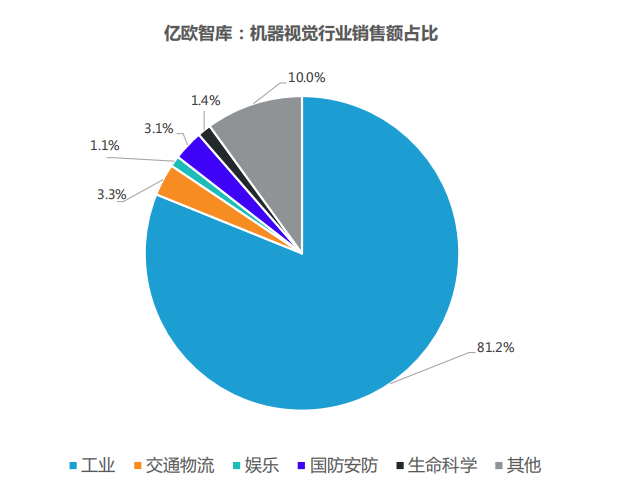

Industry is currently the largest downstream application field in China's machine vision industry, accounting for 81.2% of sales in the industrial sector, including electronic manufacturing, display panels, automobiles, printing, semiconductors, food and beverage packaging, and other industries. Other industries, transportation, entertainment, and national defense and security are supplemented, with sales accounting for 10%, 3.3%, 3.1%, and 1.1% respectively.

In various sub sectors of industrial machine vision applications, 3C electronics, semiconductors, lithium batteries, and photovoltaics rank among the top

The application direction of machine vision includes industrial and consumer levels, and the industry boundary tends to be blurred. Industrial grade machine vision used in 3C electronics, semiconductors, and new energy sectors accounts for a total of 79.8%.

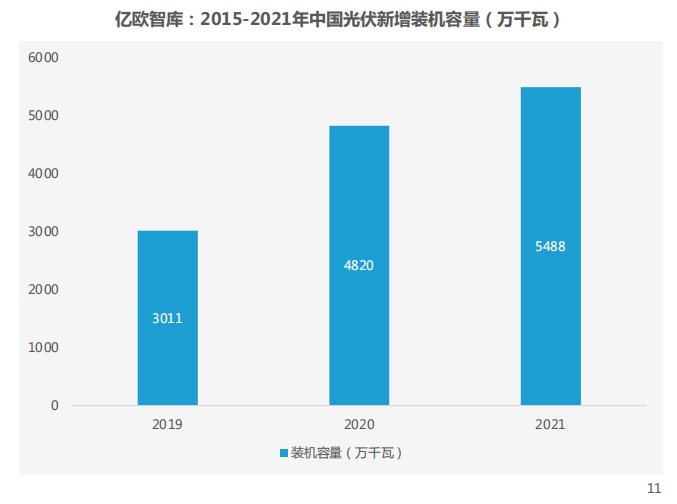

The proportion of single industries in the three major sectors of consumer electronics, semiconductors, and lithium-ion batteries ranks among the top three, accounting for 28%, 13%, and 13% respectively. The development direction of industrial machine vision closely follows policy guidance, and for the development of the new energy field, in addition to lithium batteries, photovoltaics are also a key development object. Yiou Think Tank believes that the four major tracks worth paying attention to in the field of industrial machine vision are 3C electronics, semiconductors, lithium batteries, and photovoltaics.

It is estimated that each photovoltaic cell production line incurs losses of up to $600000 per year due to defects. With the upgrading of solar silicon wafer manufacturing technology, large-sized solar cells are imperative, which makes solar silicon wafers more prone to damage defects. Therefore, continuous and effective defect detection methods are crucial for improving the quality of finished solar silicon wafers.

The following is an excerpt from the main text of the report: