Introduction

Intelligent manufacturing equipment refers to manufacturing equipment with sensing, analysis, reasoning, decision-making, and control functions. It is the integration and deep integration of advanced manufacturing technology, information technology, and intelligent technology, reflecting the development requirements of intelligent, digital, and networked manufacturing industry. The level of intelligent manufacturing equipment has become an important indicator of a country's industrialization level today. Machine vision, as a typical industry in the field of intelligent manufacturing, can greatly reduce labor input and maintain accuracy in recognition, detection, measurement and other scenarios. It is an important step in achieving automated production in the industrial production field.

Machine vision concepts

Machine vision refers to the use of sensors such as cameras and cameras, combined with machine vision algorithms, to endow intelligent devices with the functions of the human eye. It is an important branch technology in the field of artificial intelligence, and its underlying logic is to implant the "human eye and brain" into machines for object recognition, detection, measurement, and so on.

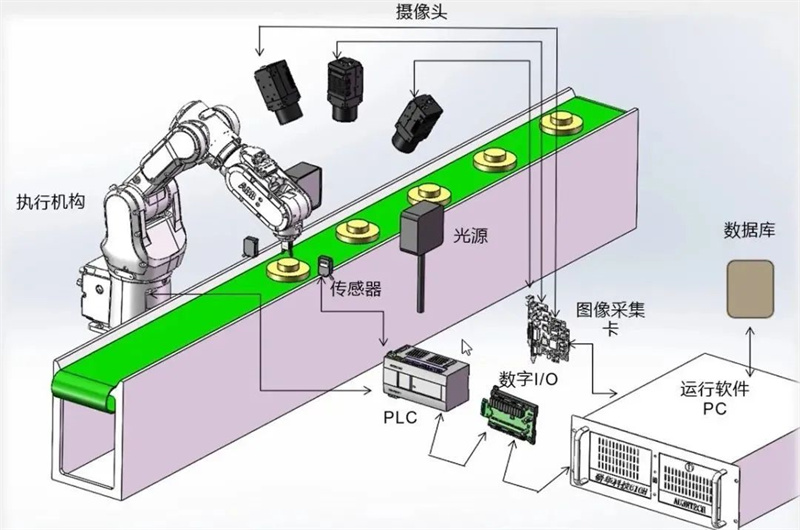

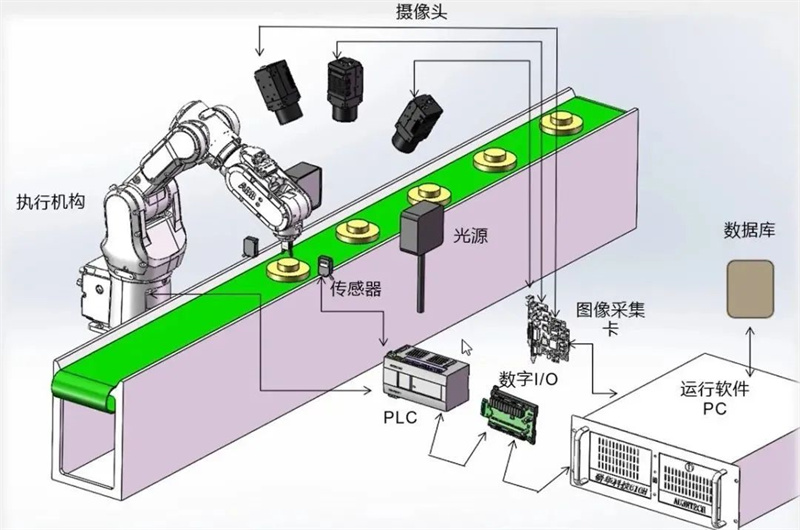

The working principle of machine vision is mainly to capture the image of the detected object through machine vision products including industrial cameras and industrial lenses, convert its information into image signals, and then convert the brightness, color, and size information transmitted to the image processing system into digital signals. The machine vision system finally calculates these signals to extract target features and uses their calculation results to control on-site equipment.

Machine vision is a system engineering discipline that encompasses a wide range of technologies, software and hardware products, integrated systems, actions, methods, and professional knowledge. It involves technologies such as image processing, mechanical engineering, lighting, optics, sensing, algorithms, and computer technology, attempting to integrate existing technologies in new ways and apply them to solve real-world problems.

The rise of machine vision stems from the growing technological demand for industrial automation production, and technological exploration began in the mid-1960s with American scholar L R. Roberts' research on understanding the block world composed of polyhedra mainly focused on developed regions such as North America, Europe, and Japan in its early stages of development. With the transfer of global manufacturing to China, the Chinese machine vision industry has entered a stage of catching up.

In the past decade, dozens of domestic research and development manufacturers of core machine vision components have emerged, from cameras, capture cards, light sources, lenses to image processing software. China is becoming one of the most active regions in the world for the development of machine vision. With the continuous development of intelligent manufacturing technology, China's machine vision industry will also usher in a new explosion. The completeness of related technologies and industry chains is constantly strengthening, and some regions have begun to focus on laying out the entire machine vision industry chain.

Figure 1: Conceptual diagram of machine vision system (source: Brief description of machine vision)

The scale of China's machine vision market

The market size of China's machine vision industry continues to grow.

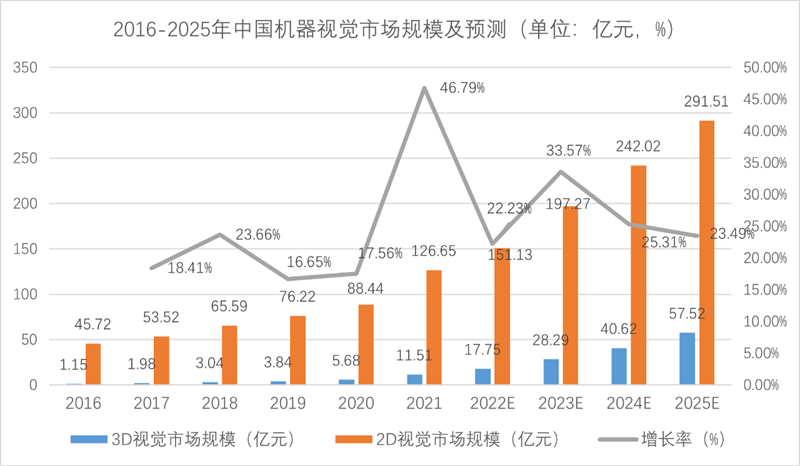

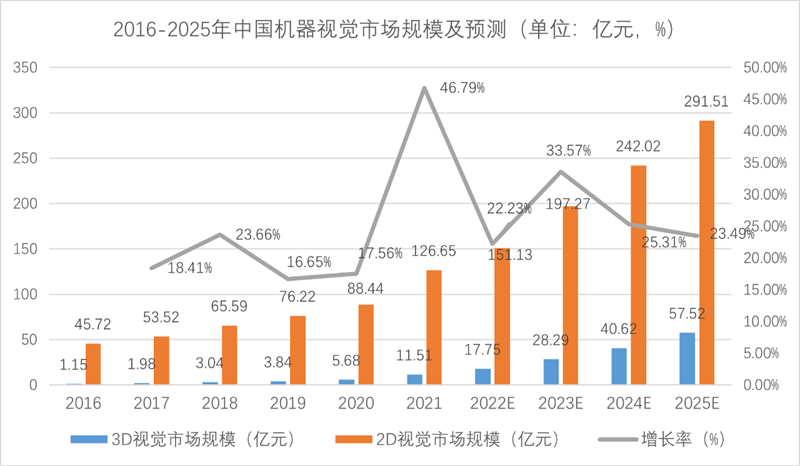

In 2021, the booming development of logistics and warehousing, as well as the new energy industry, has driven the expansion demand of related enterprises, with a significant increase in demand for visual inspection products. According to data from the Institute of Advanced Robotics Industry (GGII), the size of China's machine vision market in 2021 was 13.816 billion yuan (excluding the scale of automation integration equipment), a year-on-year increase of 46.79%.

Among them, the 2D visual market size is about 12.665 billion yuan, and the 3D visual market size is about 1.151 billion yuan; The recovery of traditional industrial products has also brought vitality to machine vision, with a clear growth trend. GGII predicts that by 2025, the size of China's machine vision market will reach 34.9 billion yuan, of which the 2D vision market will exceed 29.1 billion yuan and the 3D vision market will exceed 5.7 billion yuan.

Figure 2: Market size of Chinese machine vision

Panorama of the Machine Vision Industry Chain

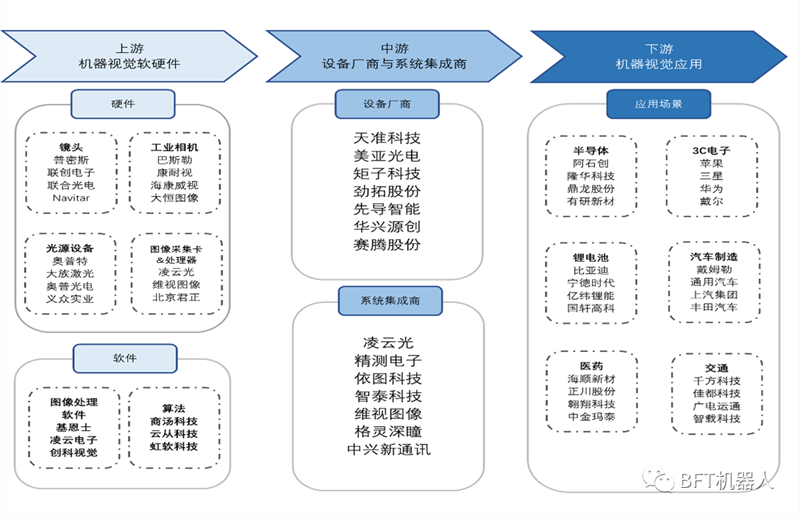

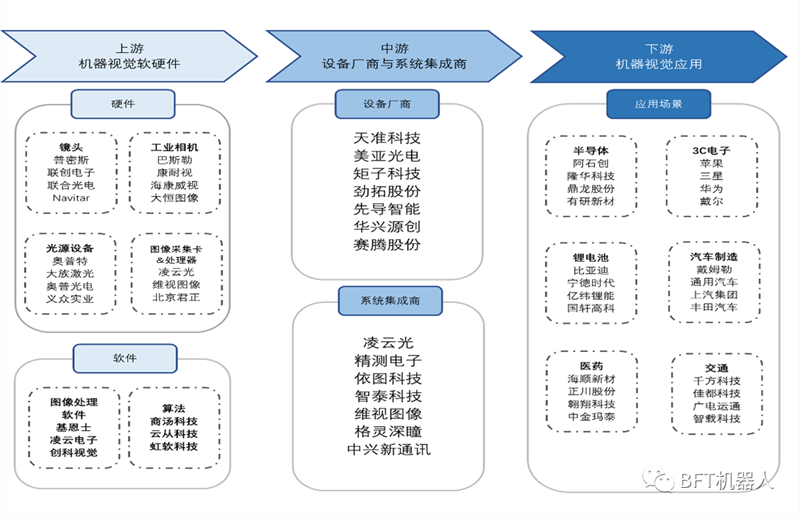

In the industry chain of machine vision, the upstream hardware includes light source equipment, industrial lenses, industrial cameras, image processors, and image acquisition cards; The software includes image processing software and underlying algorithms. The midstream is an industrial visual equipment manufacturer and system integrator. Machine vision has a wide range of downstream applications, including semiconductor, automotive, packaging, 3C electronics, industrial robots, and other industries. The following image is a panoramic view of the machine vision industry chain, including the main products of each link and representatives of domestic and foreign manufacturers.

Figure 3: Panorama of China's Machine Vision Industry Chain

Upstream of Industrial Machine Vision Industry Chain

Including light sources, industrial lenses, industrial cameras, image capture cards, image processors, software, and algorithm platforms, among which core components such as industrial lenses, cameras, capture cards, and algorithm software are the most valuable parts of machine vision, accounting for 80% of the total cost of industrial vision products.

The midstream of the machine vision industry chain is the core link of the industry chain

Including machine vision equipment manufacturers, system integration manufacturers, technology partners, etc. The core focus of midstream manufacturers is on engineering construction, linking operators and functional blocks, mainly through independent research and external collaboration. The products of midstream manufacturers mainly include detection equipment, measurement equipment, guidance equipment, and identification equipment.

The downstream markets of the machine vision industry chain are mainly various application industries

From the perspective of the distribution of manufacturing applications, the further intensification of competition between 3C, semiconductors, lithium batteries and the automotive manufacturing industry, as well as the continuous increase in cost pressure in various manufacturing industries, directly drive the penetration rate of machine vision in the manufacturing industry.

According to data from the Head Leopard Research Institute, as of 2021, 3C electronics in the downstream manufacturing industry of machine vision is the largest application market for machine vision, with an application proportion of 31%; Next are the semiconductor and lithium battery manufacturing industries, with machine vision applications accounting for 13%.

Machine vision technology can further help enterprises reduce costs, increase efficiency, and reduce errors in product manufacturing processes, and its application in the manufacturing industry will continue to deepen. The majority of machine vision applications in non manufacturing industries are security monitoring, logistics sorting, and intelligent transportation, with a combined proportion of 65%.

The current situation and distribution of "chain owners" in the machine vision industry chain

The Chinese machine vision market is mainly dominated by international participants.

Developed countries such as Europe, America, and Japan are ahead of China in the development of machine vision technology and industry. The main participants in global machine vision are international manufacturers represented by KEYENCE, COGNEX, BASLER, etc. Chinese manufacturers are in an accelerated catch-up stage. In 2021, the global machine vision market has a high concentration, with Keyence taking the lead with a share of 54.9%, 38% in the Chinese market, followed by Cognex.

Although the development of China's machine vision industry was relatively late and the early stages were mainly based on agency models, with the increase in the number of local machine vision enterprises in China, and local manufacturers relying on providing customized services and cost-effectiveness advantages for downstream customers, their market share continues to increase. Local manufacturers represented by Tianzhun Technology and Optoelectronics have entered the top ten in China's market share, and the Chinese machine vision industry is expected to further improve its localization rate.

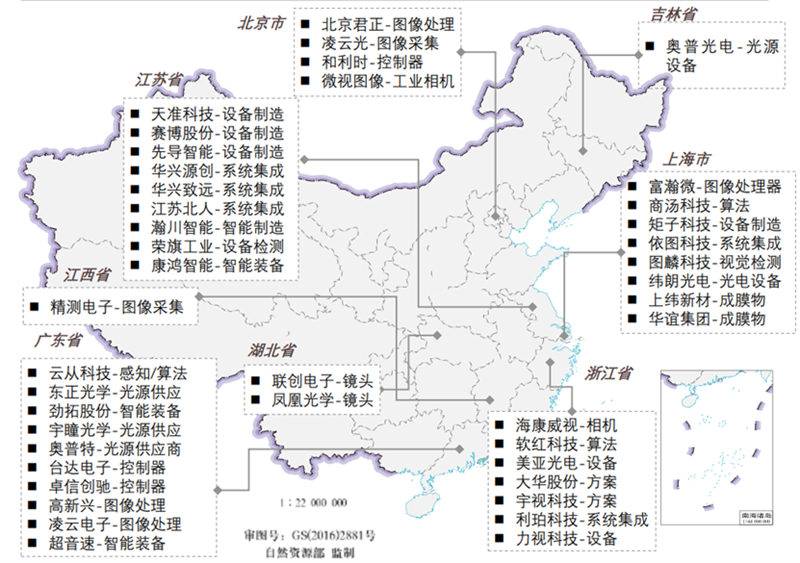

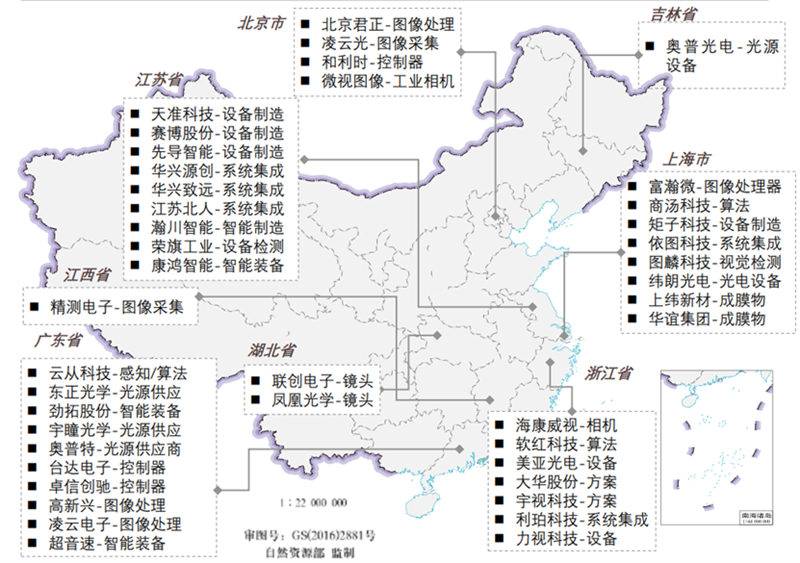

Chinese machine vision technology is widely used in the industrial field, so the industrial distribution is closely related to the geographical location of developed manufacturing areas in China, with a concentration in Guangdong Province, Jiangsu, Zhejiang, and Shanghai.

At the same time, as a field with high technological barriers in the field of artificial intelligence, machine vision in Guangdong Province, Jiangsu, Zhejiang, and Shanghai regions, as well as Beijing, has a relatively developed financial collaborative environment and entrepreneurial soil, making it a mainstream input area for Chinese talents. Therefore, multiple leading enterprises in the middle and upper reaches of the Chinese machine vision industry chain have emerged in these regions.

The specific distribution of key enterprises in the machine vision industry chain is shown in the following figure. Among them, Guangdong Province has a relatively complete layout of machine vision detection equipment, algorithms, and integration, while Jiangsu Province and Zhejiang Province have more equipment manufacturing and system integrators. There are relatively few machine vision enterprises in the central, western, and northern regions of China, and they are still in the developing stage.

Figure 4: Representative Regional Distribution of China's Machine Vision Industry Chain (Source: White Paper on the Development of China's Machine Vision Industry)

Note: * This article (including images) is a reprint. If there is any infringement, please contact us to delete it.