01 Core points

Core viewpoint:

Industrial machine vision is an excellent track with high technological barriers, mature business models, rapid domestic substitution, and rapid industry development. Industry side: 3C Electronics is the main industry, with the fastest growth rate in the new energy industry, benefiting from quality control policies and high industry growth. On the technical side, AI technologies such as large models and 3D vision will open up more industrial scenarios, promote standardization, and help enterprises reduce costs and increase efficiency.

With the intelligent transformation of China's manufacturing industry, machine vision will deeply empower the entire industrial process.

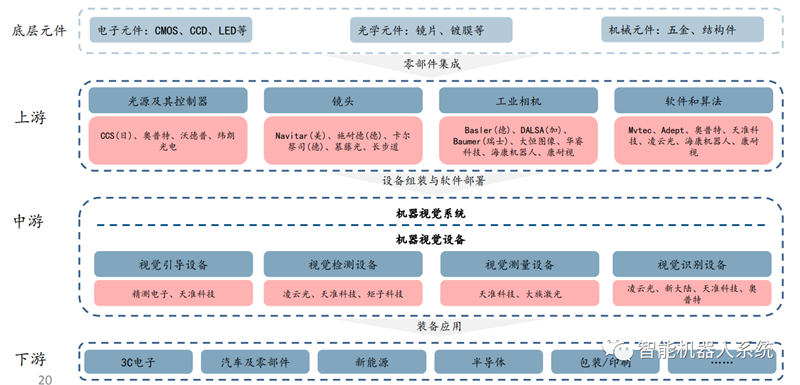

1. High tech wall gold track, with high upstream value in the industrial chain.

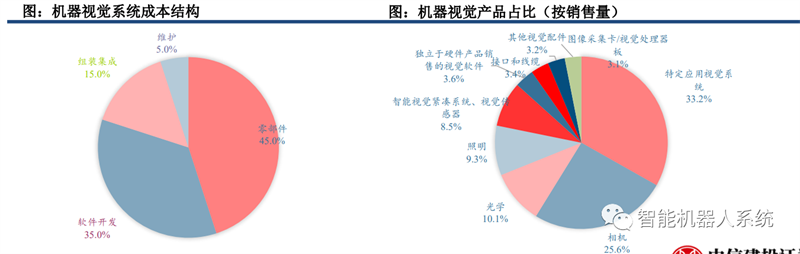

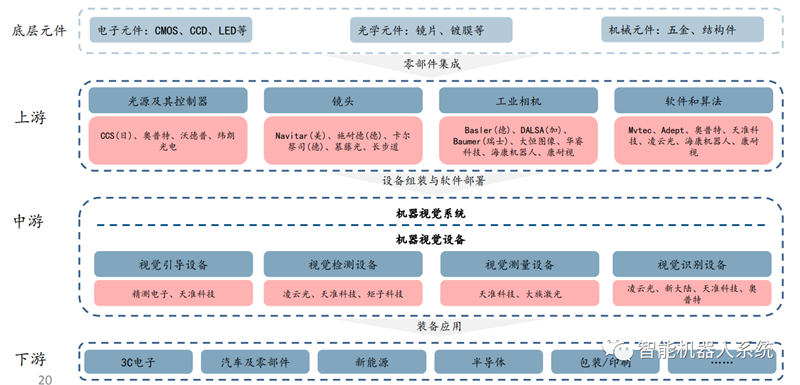

Industrial machine vision is an industry that integrates various technologies such as optical imaging, artificial intelligence, and automation control, with high technological barriers. Compared to other AI tracks at the same time. Having more mature technology and business models. The upstream of the industrial machine vision industry chain consists of components and software algorithms, while the midstream consists of visual equipment and solutions. Downstream refers to specific application field numbers and industries. Upstream components and software algorithms account for 80% of the value of machine vision.

2. The triple benefits of technology, industry, and policy are driving the development of China's machine vision industry.

On the technical side, 3D vision technology and deep learning are gradually maturing, and industrial machine vision is expected to achieve penetration in more complex industrial inspection scenes. The proposal of the AI big model will promote the standardization process of software and help enterprises reduce costs and increase efficiency. On the industrial side, with the demand for intelligent transformation in the manufacturing industry. The penetration rate of machine vision equipment will increase.

3. The technology of domestic manufacturers is gradually maturing, and domestic substitution is timely.

In recent years, the market share of domestic manufacturers has been on the rise. In 2021, domestic manufacturers accounted for nearly 50% of the market share and have strong competitiveness in markets such as mid to low-end components. At the same time, domestic manufacturers actively layout the high-end component market through technological research and development, investment and mergers and acquisitions. Some products already have certain international competitiveness. For example, Cognex's machine vision business in China has shown a slowing growth trend, with year-on-year growth rates of 46%/19%/13% in 2020/2021/2022, respectively.

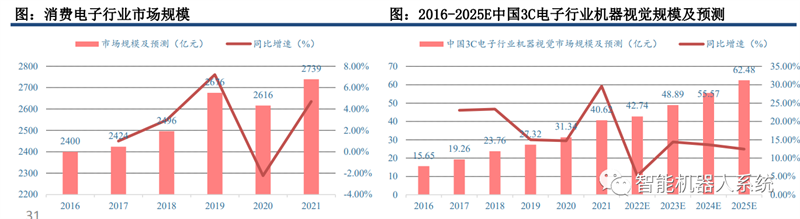

4. The downstream application demand is clear, and 3C electronics is the main machine vision market, with the rapid rise of new energy gradually becoming the main growth market.

Benefiting from the gradual penetration in more aspects of 3C electronics and the stable demand brought by continuous delivery on the production line. Stable growth of 3C machine vision: The new energy industry benefits from clear quality control requirements. Machine vision is being applied in more aspects, and the industry is expanding, resulting in a better competitive landscape. GGI predicts that the CAGR of the machine vision market size in China from 2021 to 2025 will reach 45.11%.

02 Macro analysis of machine vision industry

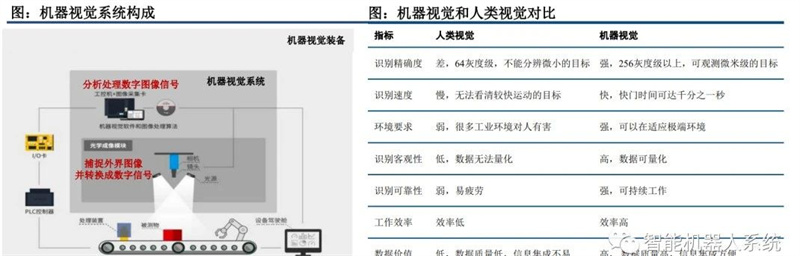

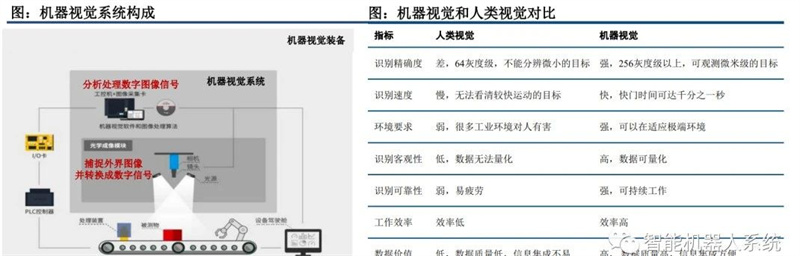

2.1 Industrial machine vision is an integrated application system of software and hardware

Industrial machine vision is an integrated system of software and hardware, which aims to replace the human eye in observing and judging the object being measured. In terms of composition, the hardware equipment of the machine vision system mainly includes light sources, lenses, cameras, etc., while the software mainly includes traditional digital image processing algorithms and deep learning based image processing algorithms. When the system is working, it first relies on the hardware system to capture and convert external images into digital signals for feedback to the computer. The process is shown in the dark gray box in the following figure, and then the digital image signal is processed using software algorithms, as shown in the gray box in the following figure.

Industrial machine vision plays a crucial role in the accuracy, speed, objectivity, reliability, work efficiency, and environmental requirements of recognition

In terms of data value, it is superior to the human eye.

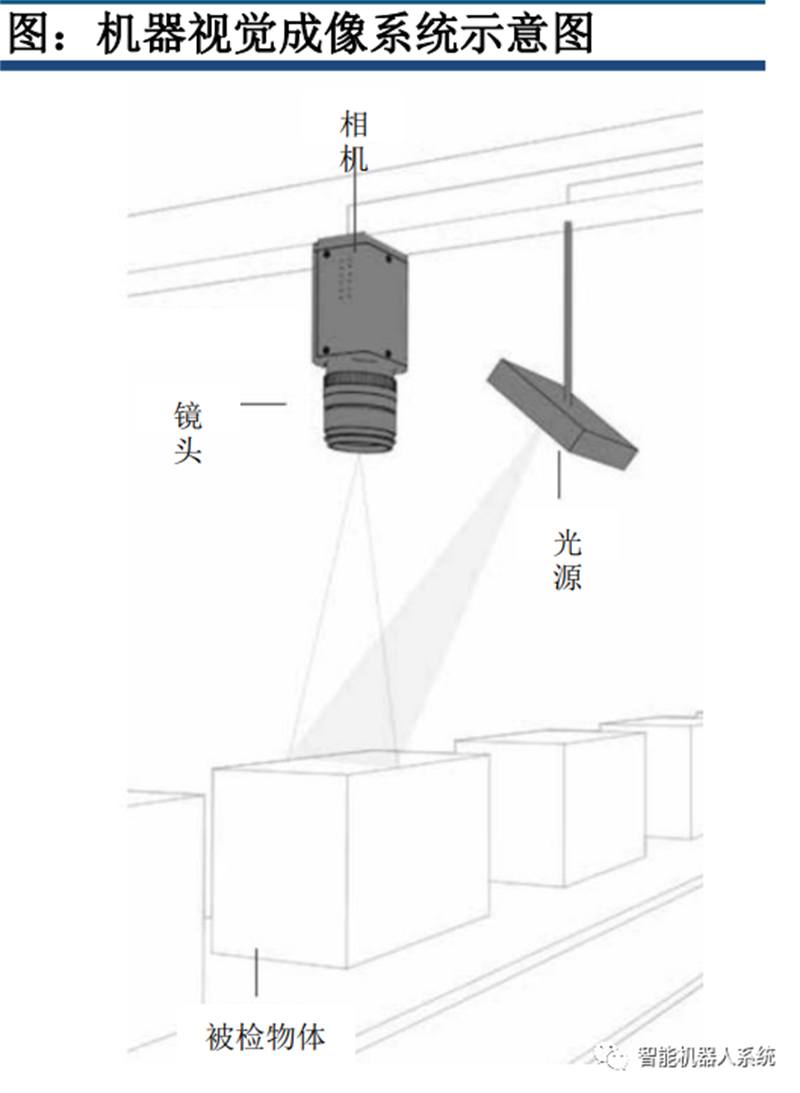

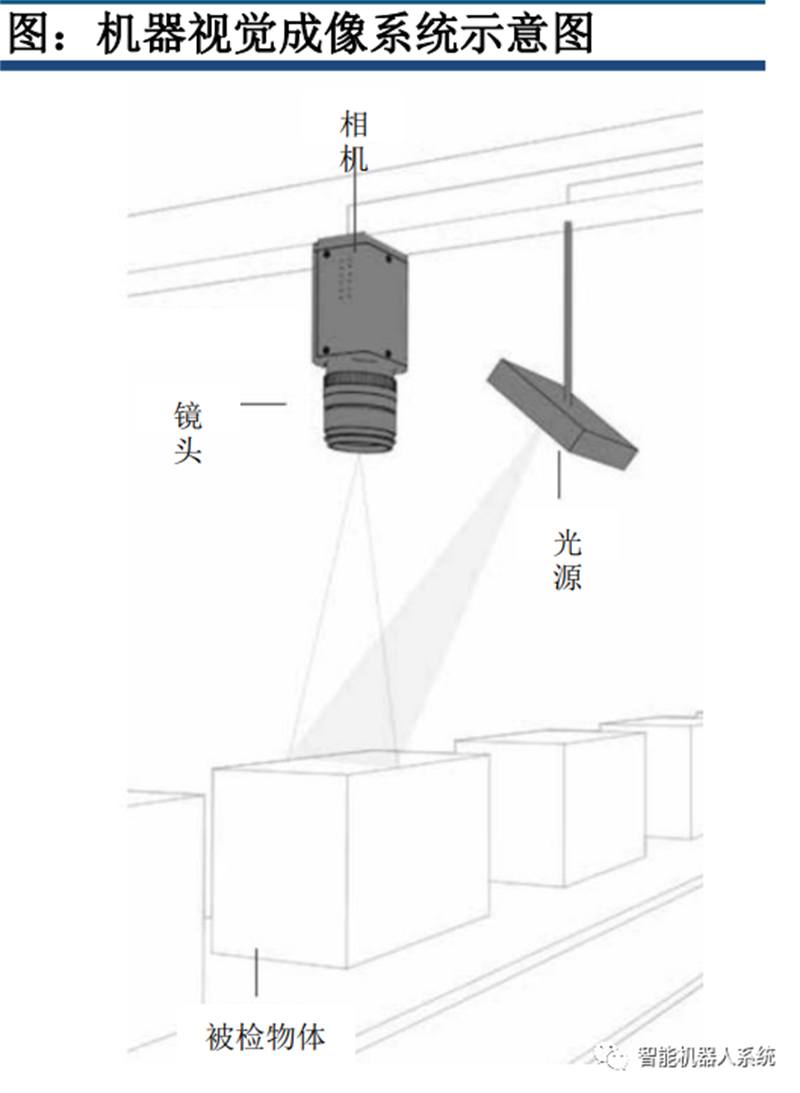

2.1.1 Machine vision "eyes": imaging systems composed of light sources/lenses/cameras

Light source: creates favorable conditions for image acquisition, or serves as a tool and reference for measurement.

Machine vision systems form images by analyzing the reflected light on objects. Different light source schemes can enhance or weaken different features, thereby improving the imaging effect. For example, by enhancing the contour features of objects through backlighting, it is easier to measure the size of objects. Special light source schemes can also serve as measurement tools and references, such as structured light in 3D machine vision.

Lens: Capture images and send them to the camera

The lens is the starting point of the process of machine vision collecting and transmitting information about the subject, and its function is equivalent to the lens in the eye. Different lenses have different optical indicators such as resolution, contrast, depth of field, and aberration, which have a critical impact on imaging quality.

Camera: Convert the light signal transmitted by the lens into a digital signal for subsequent processing and analysis

The image sensor in the camera is a key component, which converts light signals into electrical signals through CCD or CMOS technology, and its function is equivalent to the retina in the eye. Compared to civilian cameras, industrial cameras require higher transmission power, anti-interference ability, and stable imaging ability.

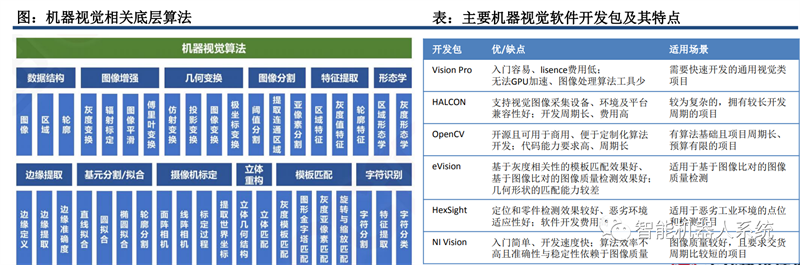

2.1.2 The "Brain" of Machine Vision: Algorithm+Software Platform

The algorithm software part of the machine vision system utilizes computer vision algorithms to analyze the acquired images and provide the necessary information for further decision-making.

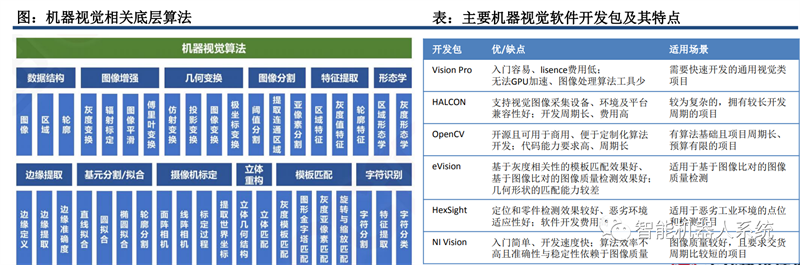

According to the different levels of integration and development difficulty, it can be subdivided into underlying algorithms for integrators and equipment manufacturers to develop and secondary developed algorithm packages for end customers to use. Due to the differences between different industrial application scenarios and high precision requirements, specialized software algorithms need to be designed to meet visual needs in industrial scenarios. The left figure below shows the relevant underlying algorithms, and the specific functional implementation in industrial scenarios is developed based on these underlying algorithms. The right figure below shows the main machine vision software development package, which includes the relevant underlying algorithms.

2.1.3 Machine vision can achieve various functions from easy to difficult

Machine vision can achieve functions such as appearance inspection, recognition verification, size measurement, and guided positioning.

The functions of machine vision are mainly divided into four categories. In terms of technical implementation difficulty, the difficulty of recognition verification, guided positioning, size measurement, and appearance inspection increases. However, the various subdivision functions based on the four basic functions also have differences in implementation difficulty.

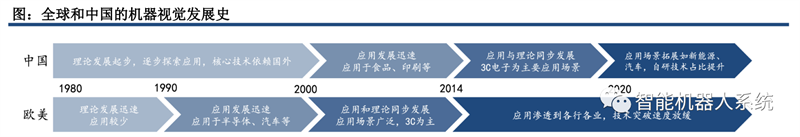

2.2.1 History of Machine Vision Development: Focus on breakthroughs in core technologies and expansion of downstream applications

With the transformation and upgrading of the manufacturing industry and the continuous strengthening of quality control requirements, machine vision is gradually achieving breakthroughs in core technologies and expanding downstream application scenarios.

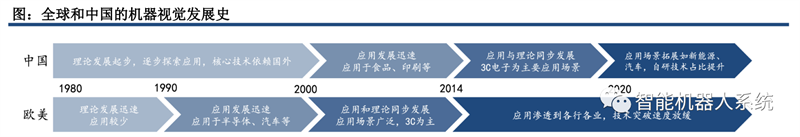

Europe and America: On the application scenario level, it began to develop from the development of high-end manufacturing industries such as automobiles and semiconductors since the 1980s; The rapid development of consumer electronics in the future has become the most important application scenario of machine vision: the increasing requirements for production and manufacturing in various industries have also promoted the gradual penetration of machine vision in various industries. On the level of technical capabilities, there has been a gradual shift from early 2D based pattern matching to new technologies represented by deep learning and 3D visual detection.

China: At the application scenario level, it matches the development of China's manufacturing industry and was first applied in scenarios such as food, printing and packaging. The rapidly developing 3C electronics has become the most important application scenario. In recent years, with the transformation and upgrading of China's manufacturing industry, such as semiconductors, automobiles, and the rise of emerging industries such as new energy, more application scenarios have gradually penetrated. On a technical level, from early reliance on overseas technology to gradually achieving self-developed core technologies, it has now reached a global leading level in some fields.

The expansion of application scenarios provides a broad market space for machine vision, and technological breakthroughs lay the foundation for the ability of machine vision to be applied in more scenarios. Both are important factors in analyzing the development history, current situation, and prospects of machine vision.

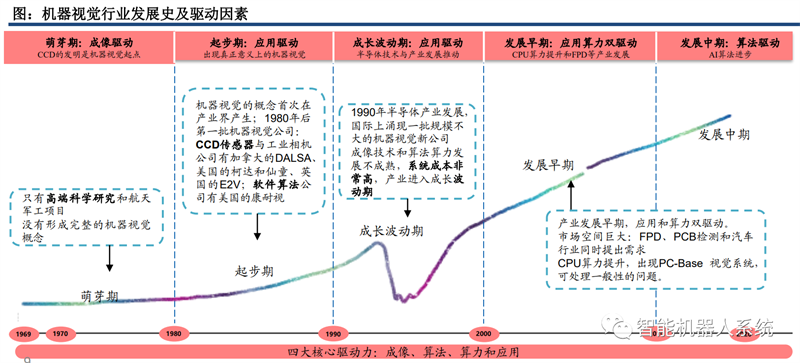

2.2.2 Development history of machine vision: imaging, algorithms, computing power, and applications are the four core driving forces

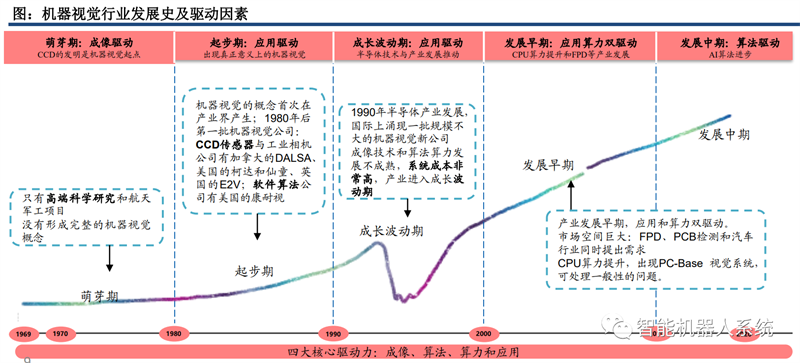

The development of AI algorithms is expected to drive the machine vision industry into a new era, driven by imaging, algorithms, computing power, and application relays.

Every decade or so, machine vision technology and applications undergo a profound transformation, and in recent years, AI algorithms are expected to drive explosive expansion in the industry.

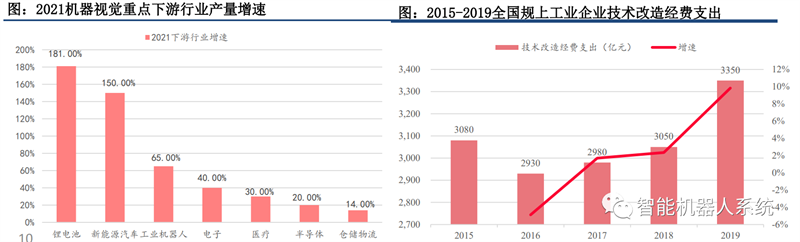

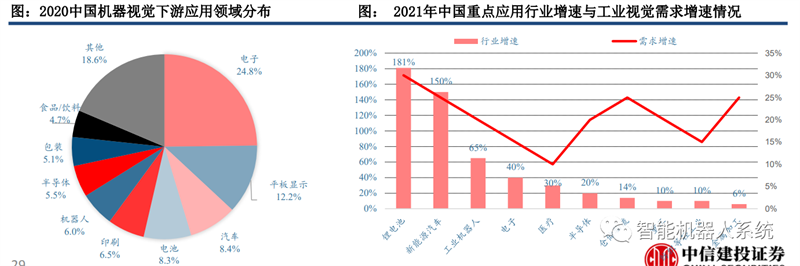

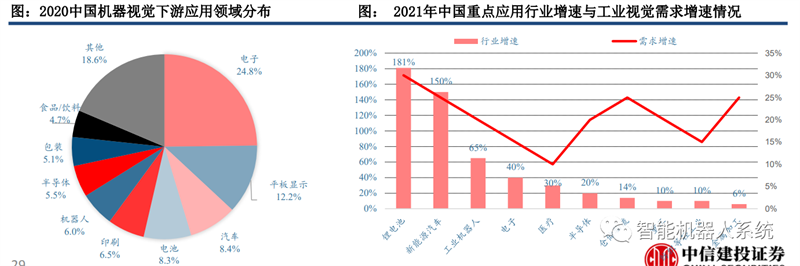

2.3.1 Industry perspective: Manufacturing transformation and upgrading continue to drive the development of machine vision

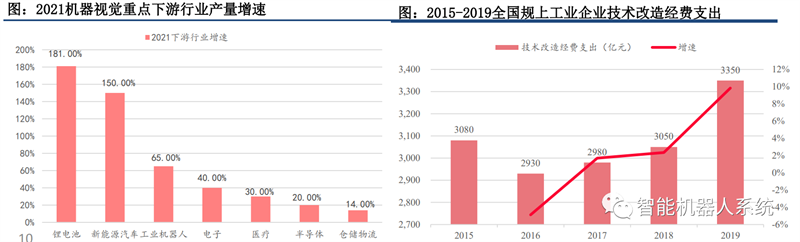

The main downstream application industries of machine vision have seen significant growth rates: in 2021, downstream industries such as lithium batteries, new energy vehicles, industrial robots, and electronics have seen faster growth rates, reaching 181%, 150%, 65%, and 40%, respectively. The demand for digitization and intelligence is constantly increasing, and downstream application scenarios are steadily growing, with the potential for demand to be released.

Strong willingness for technological transformation in industrial enterprises: With the gradual development of manufacturing enterprises in China towards refinement, digitization, and intelligence, the technological transformation of industrial enterprises in China is strong. The funding for technological transformation in national industrial enterprises has been continuously increasing since 2017, which is beneficial for the penetration rate of machine vision equipment in downstream industrial sites. We believe that the digital transformation and upgrading of China's manufacturing industry will drive the expansion and penetration rate of machine vision application scenarios, providing strong support for machine vision.

2.3.2 Technical perspective 1: Improvement of technical capabilities and application scope from 2D to 3D

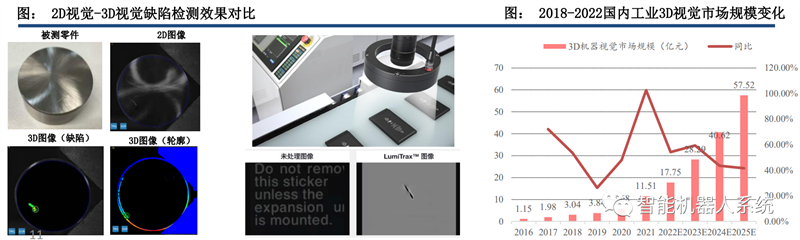

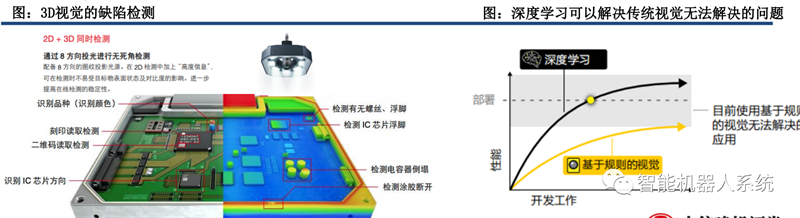

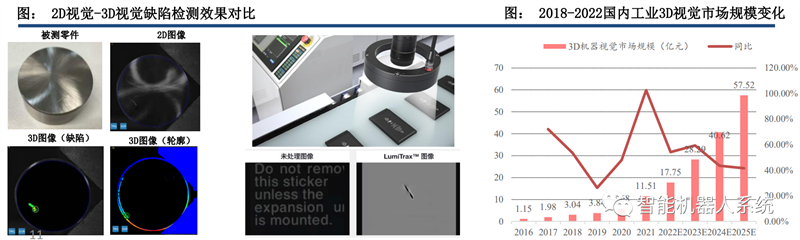

Compared to 2D machine vision, 3D machine vision can provide three-dimensional information, enabling more extensive and accurate detection and analysis.

3D machine vision can accomplish many tasks that 2D machine vision cannot.

Taking inspection as an example, there is a scratch on the surface of the part shown in the figure below and a depression on the edge. Traditional 2D machine vision can only rely on the discontinuity of surface image color to determine whether there is a defect, but in this case, the defect is close to the reflective color on the surface of the part, making the judgment difficult. 3D cameras can obtain depth information of surface roughness, accurately determining scratches and edge depressions.

3D machine vision covers a comprehensive range of scenes and has a vast market space.

At present, 3D vision technology has achieved a wider application coverage compared to 2D machine vision in more scenarios such as high-precision detection, high-precision measurement (such as bending pipes and irregular parts), intelligent building segmentation, assembly (guiding robotic arms to avoid and locate obstacles in three-dimensional space), logistics vehicle navigation, etc. It has a wide market space. According to GGI1 calculation, the market size of industrial 3D vision in China in 2021 is 1.151 billion yuan. With the development of China's high-end manufacturing industry, the demand for 3D vision applications in China will continue to maintain a high growth momentum, and it is expected to reach a market size of 5.752 billion by 2025.

2.3.2 Technical perspective 2: Empowering machine vision with deep learning to enhance specific scene analysis capabilities

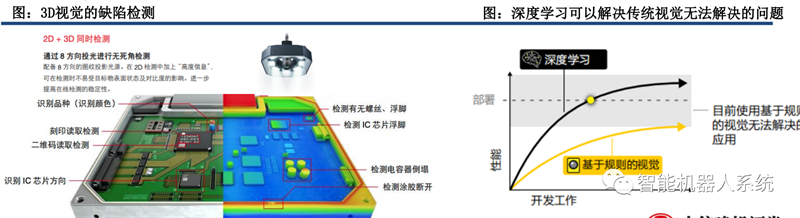

At present, industrial machine vision systems mainly adopt the traditional rule-based learning approach.

Taking defect detection as an example, first, people need to summarize the types of defects, extract features to judge various types of defects, and then train a large number of samples containing features to enable the computer to distinguish these features and determine whether there are defects. But when the detection scene becomes complex, the rule-based learning approach cannot meet the requirements well.

The combination of industrial machine vision and deep learning technology enables the expansion of application scenarios. Machine vision based on deep learning can not only identify defects but also understand their common features. Predict new types of defects to achieve better analysis for more complex scenarios. As shown in the figure below, the difference between acceptable anomalies and unacceptable defects can be determined through deep learning. However, correspondingly, the application of deep learning technology will also place higher demands on computing and storage capabilities. We believe that the development of 3D machine vision and the application of deep learning technology will promote the improvement of machine vision performance and its application in previously unsuitable scenarios.

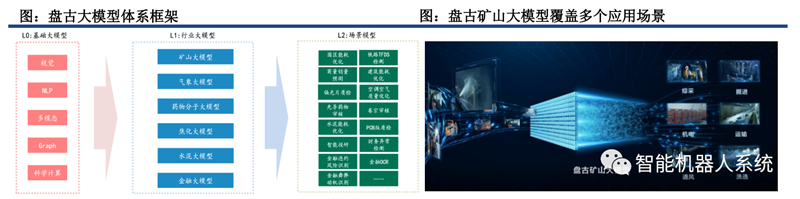

2.3.2 Technical perspective 3: Combining large models to achieve cost reduction and efficiency increase, promoting wider commercialization implementation

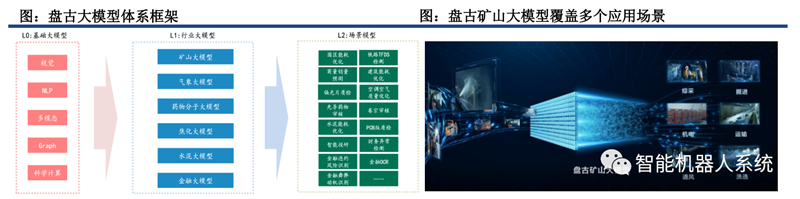

In the past, industrial machine vision systems mainly trained small models on a small amount of data in vertical scenes.

On the one hand, due to the limited amount of input from the stem model, the complexity of the problems that the model can handle is limited; On the other hand, in this training mode, if one wants to apply industrial machine vision to new scenes, it requires a larger amount of relevant scene data and retraining the model, which brings higher application promotion costs and is not conducive to widespread commercialization.

The development of large models will help improve the application performance and broaden the application scenarios of industrial machine vision.

Taking the application of Huawei's Pangu large model in mining scenarios as an example, it is based on the technology of L0's basic large model. By importing massive unlabeled mining scene data for pre training, the Pangu mining large model can perform unsupervised autonomous learning. With just one large model, it can cover more than 1000 sub scenarios in the mining, mining, machinery, transportation, and communication processes of coal mines, making it easier for AI applications to be popularized in coal mines. In terms of accuracy. The intelligent monitoring of excavation operations based on the Pangu Mine large model has an accuracy rate of over 95% in identifying action norms. The standardized A process is used to replace uncertain manual processes. Make AI a good helper for miners to standardize their operations and ensure the safety of underground operations.

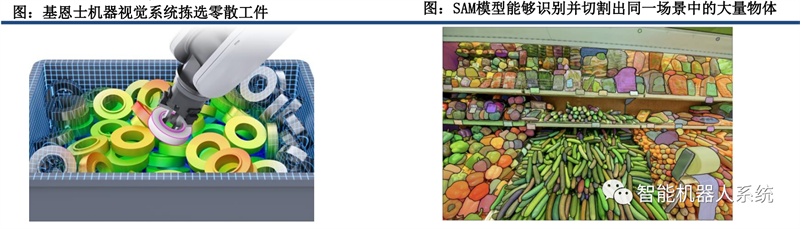

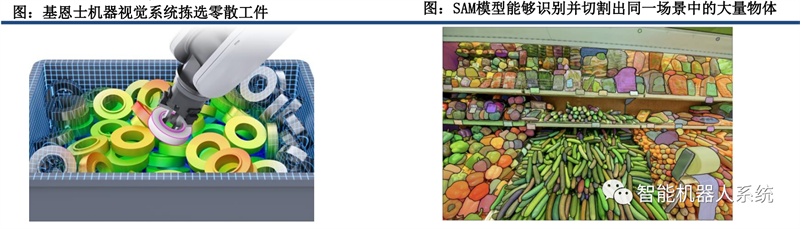

The breakthrough in visual big model technology empowers the innovation and breakthrough of machine vision: Taking the recent SAM model proposed by Meta as an example, it has shown strong generalization ability in different specific scenarios of cutting tasks, and can achieve excellent completion of different cutting tasks on the basis of zero shot and few shot.

At the same time, the SAM model also has high-precision automatic annotation capabilities, reducing data annotation costs. The development and breakthroughs of related technologies will empower the transformation of the machine vision industry in two directions:

1) Scenarios with high data and training costs in the past are expected to achieve cost reduction and efficiency improvement:

Large models have excellent capabilities in a wide range of downstream scenarios, which is expected to significantly reduce the cost of customized product development, bring about an increase in gross profit margin of machine vision products, and accelerate the expansion of application scenarios.

2) The scenarios where machine vision was difficult to apply due to insufficient sample size in the past will be expanded:

Thanks to the excellent performance of large models on zero or small samples, machine vision will be expanded in these fields, such as the robot field that has shifted from code driven to vision driven, and process industry scenarios.

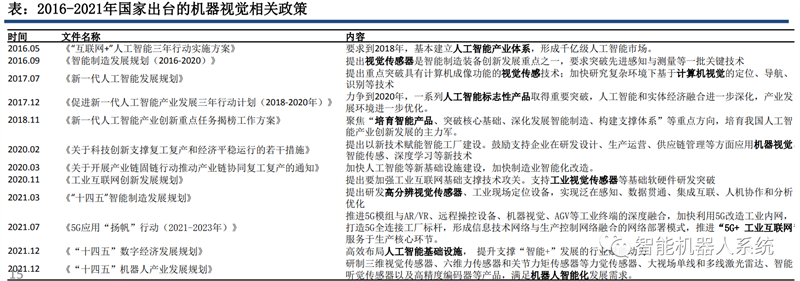

2.3.3 Policy perspective: Policy benefits support the development of machine vision

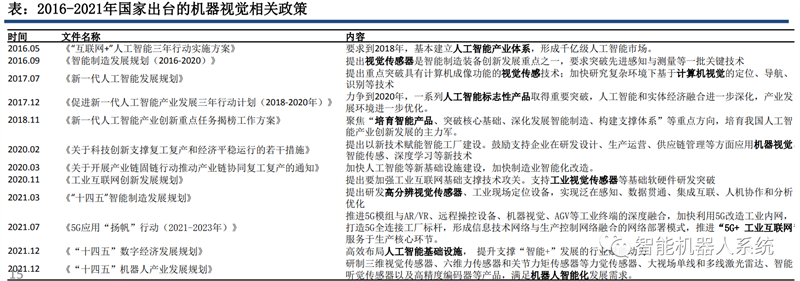

Industrial machine vision is an important link in the transformation and upgrading of the artificial intelligence industry and manufacturing industry, and is a key industry that national policies focus on and develop

Since 2016, it has been mentioned many times in the policy documents related to the upgrading of the artificial intelligence industry and intelligent manufacturing industry. In 2016, the Intelligent Manufacturing Development Plan (2016-2020), 2017's New Generation Artificial Intelligence Development Plan, 2020's Industrial Internet Innovation and Development Plan, 2021's 14th Five Year Plan for the Development of Intelligent Manufacturing, and other documents, it is proposed to focus on breakthroughs in computer vision and visual sensing related technologies, providing policy support for the development of the machine vision industry.

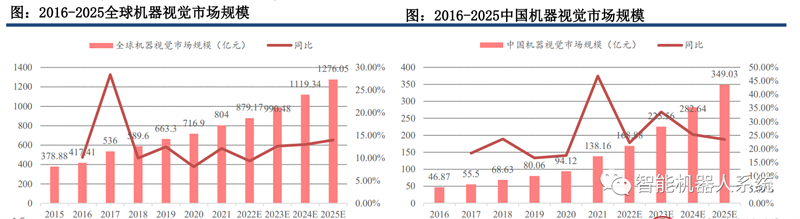

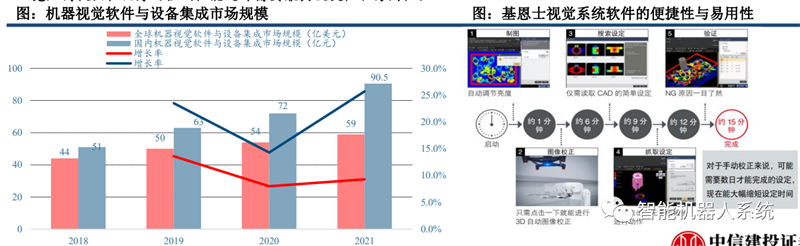

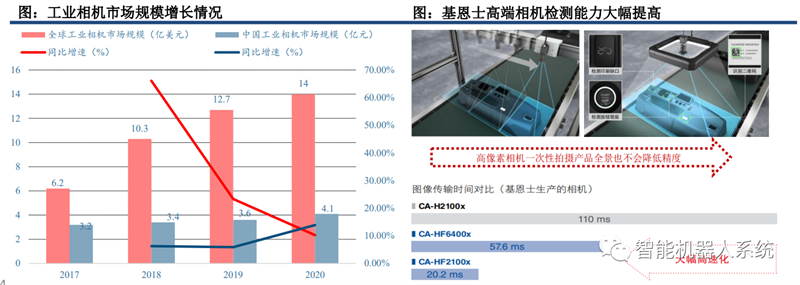

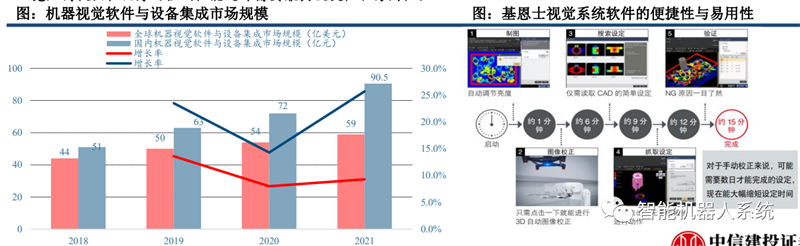

2.3.4 The global machine vision market is steadily growing in size, with significant growth in the domestic market

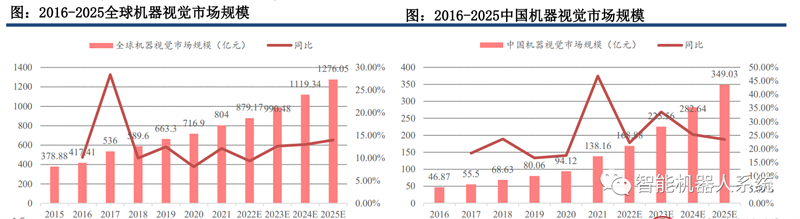

Global scale is steadily growing: According to Markets and Markets and GG data, from 2016 to 2021, the sales revenue of the global machine vision industry increased from 37.888 billion yuan to 80.4 billion yuan. It is expected that the global market size will reach 127.605 billion yuan by 2025, with a compound annual growth rate of about 13%.

The domestic market is experiencing rapid growth: According to GGI statistics, from 2016 to 2021, the scale sales revenue of the domestic machine vision industry increased from 4.687 billion yuan to 13.816 billion yuan, with a 5-year compound growth rate of 24.1%, leading the global compound growth rate by about 10 percentage points during the same period. Driven by favorable factors such as technology, industry, and policies, the sales scale of domestic machine vision will further accelerate and expand. It is expected that the sales revenue in 2022 will reach 16.888 billion yuan, and the sales revenue scale of China's machine vision industry is expected to reach 34.903 billion yuan by 2025. (Note: In 2021, due to the general increase in raw material prices, the prices of products from midstream enterprises increased by 20%. Therefore, the growth rate calculated based on sales volume during the same period was lower than that calculated based on sales volume.).

2.4.1 The market share of domestic machine vision brands continues to increase

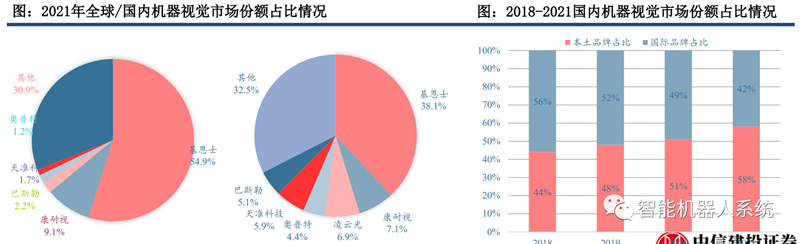

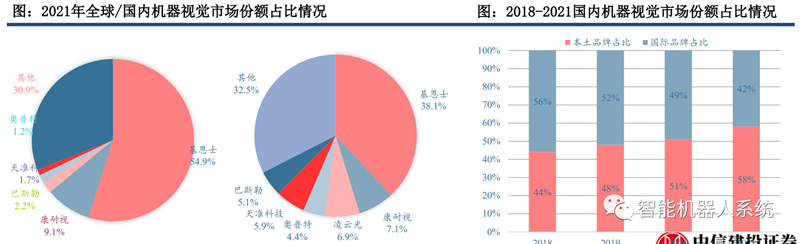

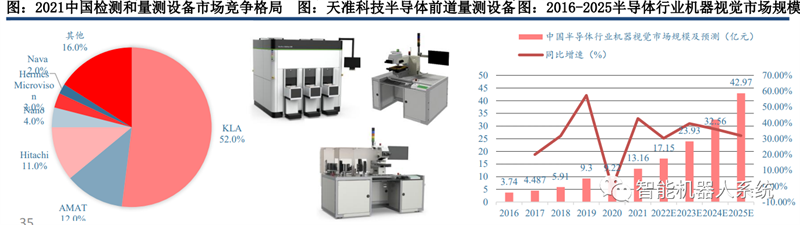

The global competition in machine vision is becoming more prominent: according to data from Huajing Industry Research Institute, Keyence and Cognex occupy nearly 65% of the market share, with excellent product strength and sales network occupying an advantageous position.

With the gradual improvement of domestic brand technology capabilities, the wave of localization of machine vision is gradually advancing, and the technical capabilities of domestic brands are constantly improving. On the one hand, they reduce their dependence on foreign technology, and on the other hand, they are gradually replacing foreign brands in market competition. The market share of foreign brands is gradually decreasing, while the market share of domestic brands is gradually increasing, but there is still a gap in the market share of high-end brands.

According to the data from Huajing Industry Research Institute, the market share of domestic machine vision in 2021 is expected to be high. Kearns and Cognex, the two major international machine vision leaders, still hold the top two positions, but domestic machine vision leaders such as Lingyunguang have already reached the same level as Cognex. Overall, according to data from the China Academy of Commerce and Industry, the proportion of local brands in domestic machine vision has increased from 44% in 2018 to 58% in 2021 (note: the statistical caliber of different research institutions may vary, but the overall trend is consistent)

2.4.2 Market perspective: The market share of domestic machine vision brands continues to increase

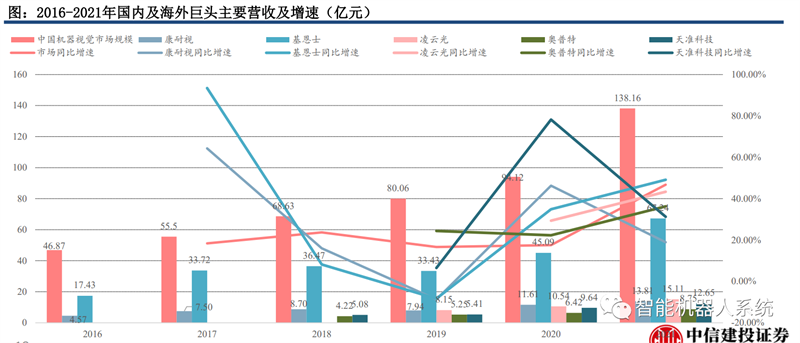

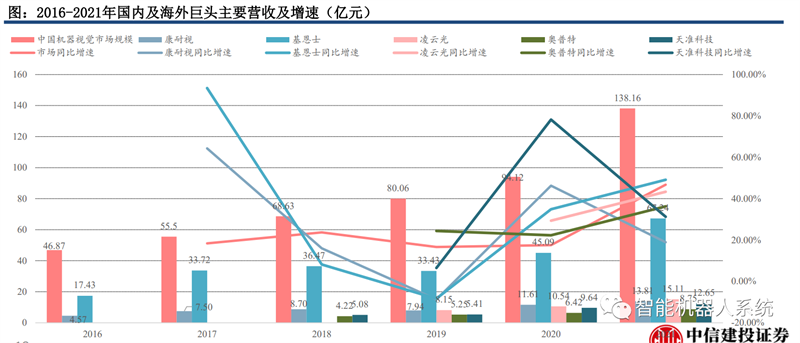

The overall growth rate of the Chinese market remains high: in 2021, the growth rates of Lingyunguang, Oppot, and Tianzhun were 43.4%, 36.3%, and 31.22%, respectively.

Differentiation of overseas giants: In 2021, Keyence maintained rapid growth, with a growth rate of 49.2%, while Cognex's growth rate significantly declined, with a growth rate of 18.92%.

03 Analysis of various links in the machine vision industry chain

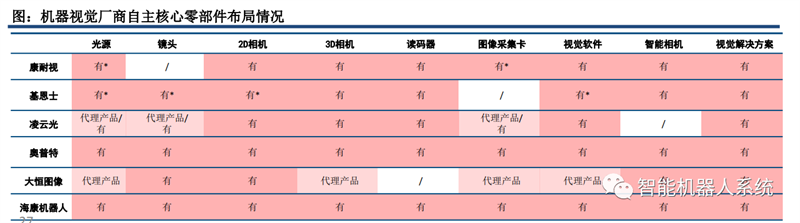

3.1 Upstream: The value of each link is high, and domestic high-end components need to be broken through

The value of upstream links in the machine vision industry is significant.

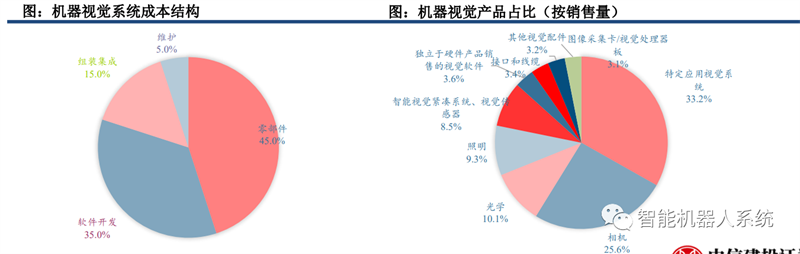

Key components and software systems account for approximately 80% of the total cost of industrial machine vision products. Industrial cameras and underlying software algorithms have high technological barriers and high profit margins. Mastering the upstream links of machine vision is currently the key to market competition. Meanwhile, core components such as cameras, lenses, and light sources account for over 50% of machine vision products.

Domestic low-end components are gradually being replaced by domestic ones, while high-end components need to be broken through.

For components with relatively low technological barriers, such as light sources, domestic manufacturers are gradually replacing foreign brands in market competition with their cost-effectiveness advantages and gradually demonstrated production capacity advantages. Components with high technological barriers, such as light sources and cameras, entered relatively late by Chinese enterprises. Currently, our products are mainly focused on the mid to low-end market, while the high-end market is still mainly occupied by foreign brands.

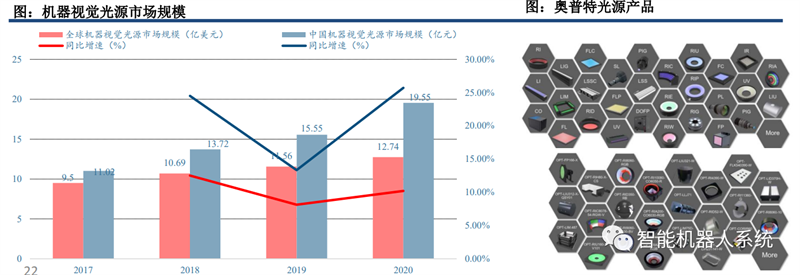

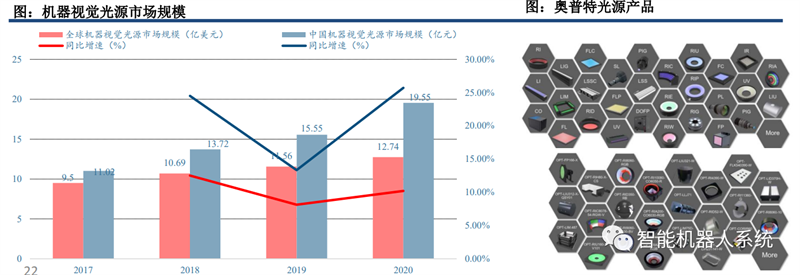

3.1.1 Light source: Domestic brands have shown strong performance and reached the international leading level

The light source segment is the most competitive segment for domestic brands.

At present, light sources are a relatively high level of Chinese production in the upstream hardware sector, and domestic brands are fully competing with foreign brands. Taking the comparison between China's leading machine vision light source company, Oppot, and the international light source company, Japan's CCS, as an example, Oppot's light source products have certain advantages in two important indicators of illumination and uniformity. At the same time, the controller products have more comprehensive functional design in terms of ease of use and safety.

Trend 1:

Light sources pay more attention to expanding their functions beyond lighting, and high-end light source products represented by structured light are gradually gaining a larger market share.

Trend 2:

As machine vision gradually permeates more complex industrial manufacturing processes, the requirements for key indicators such as illumination, uniformity, and energy consumption of light sources are gradually increasing.

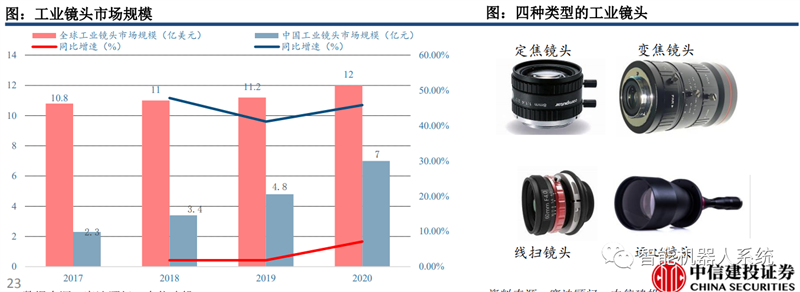

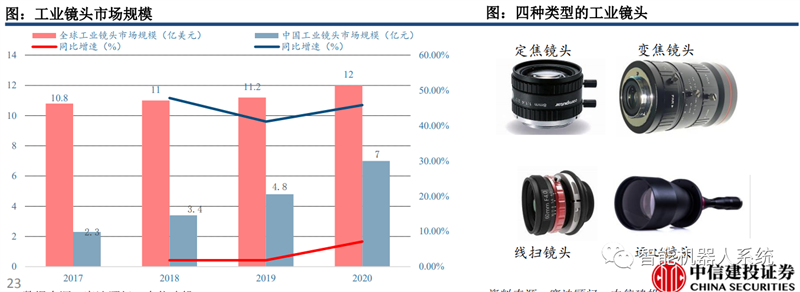

3.1.2 Lens: Technology is gradually maturing, and domestic substitution is gradually advancing

Domestic manufacturers are gradually entering the field of industrial lenses, and their technology is gradually maturing.

Before 2008, the lens market in China was basically monopolized by Japanese and German brands. However, with the gradual layout and entry of domestic manufacturers into the industrial lens field, domestic industrial lenses are now in the mid to low-end lens market and can basically meet the needs of machine vision systems. With the further promotion of industrial lens research and development by domestic manufacturers such as Optoelectronics and Changbudao, it is expected to further achieve domestic substitution in the high-end lens market.

Trend 1:

With the gradual penetration of machine vision into more complex industrial manufacturing processes, the demand for high-performance lenses such as high-resolution lenses and wide-area lenses is gradually increasing.

Trend 2:

With the continuous enrichment of downstream application scenarios, the demand for customized industrial lenses is increasing, and many midstream machine vision enterprises are accelerating their layout of the lens process.

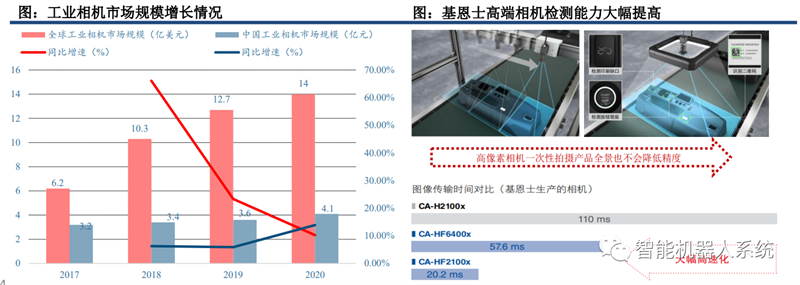

3.1.3 Industrial Cameras: Domestic manufacturers are starting to lay out, with a clear trend towards "intelligence"

Domestic brands are starting to lay out industrial cameras.

Industrial cameras have the highest technological barriers and the fastest technological iteration among the upstream components of machine vision. Their market size is also larger than lenses and light sources, making them one of the most promising sub sectors. However, research on industrial cameras in our country started relatively late. In the early days, it mainly represented foreign brands, and in recent years, domestic brands have gradually launched independently developed industrial cameras. Currently, it still mainly focuses on the mid to low-end market.

Trend 1:

CMOS sensor technology is gradually maturing, with advantages such as high integration, easy resolution and frame rate improvement, and will become the main technical solution for industrial cameras.

Trend 2:

To solve complex problems in higher difficulty industrial manufacturing scenarios, industrial cameras exhibit the characteristics of simplified detection, high-speed processing, and intelligence.

3.1.4 Algorithm software: The algorithm is self-developed and presents a trend of technical standardization and software convenience

The development of software algorithms is difficult, and domestic brands have a high degree of self-development.

The development cycle of algorithm libraries is long and requires a large investment. Industry companies usually develop their own application algorithms based on open-source algorithm libraries, or independently develop and integrate with third parties. At present, top domestic brands have independently developed commercial machine vision algorithm libraries, such as VisionWare and SciVision.

Trend 1:

As downstream customer demands become more diverse, algorithms/software require more use of "standardized technology" to achieve matching of different application scenario requirements. Software algorithm development is more comprehensive, and manufacturers who can meet the needs of different application scenarios have stronger competitiveness.

Trend 2:

With the continuous popularization of machine vision technology in the industrial field, on-site engineers have become potential users of algorithm software and development tools, thus driving machine vision manufacturers to provide convenience and ease of use in addition to excellent detection performance.

3.2 Mid stream: Specifically divided into systems and equipment, the detection technology in the equipment is relatively difficult

The midstream of the machine vision industry is divided into machine vision systems and machine vision equipment based on equipment integration.

The machine vision system consists of optical imaging hardware and image processing software and algorithms, which are the "eyes" and "brain" parts of the machine and need to be combined with other products or automated machines to work.

On the basis of the system, machine vision equipment has added additional automation platforms (machines/robotic arms), which can independently carry out work. The midstream of the machine vision industry is divided into measurement/positioning/recognition/detection equipment according to specific application needs, among which the demand for detection equipment and technical barriers are relatively high: in terms of market size, the scale of detection equipment accounts for about 25.0% of the overall scale of machine vision equipment.

The technical difficulty presents a ranking of "detection>positioning>measurement>recognition". The reason is that object-oriented detection mainly involves various types of defects, with characteristics such as subtle details, rich types, and non fixed features, making it technically difficult. Relatively speaking, recognition, positioning, and measurement in industrial scenarios often face more standardized recognition objects (such as industrial barcodes), which are less difficult.

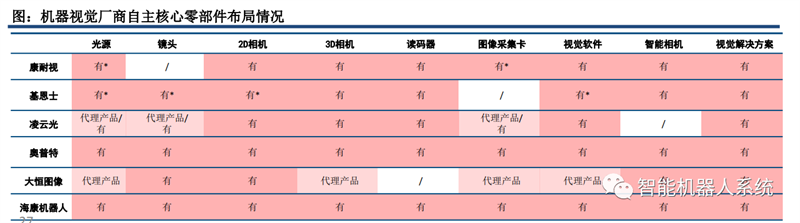

3.2.1 Vertical: Expand the layout of the industrial chain, promote independent research and development/deep cooperation in upstream and downstream links

Machine vision upstream component manufacturers and midstream system/equipment manufacturers are gradually expanding their industrial chain layout through industrial investment/independent research and development, in order to further improve the performance of machine vision products and build a higher technological moat in the increasingly competitive machine vision industry.

Oppt and Hikvision Robotics have achieved full coverage of machine vision core components and software algorithms through independent research and development. Lingyunguang expands its layout of MOS sensor chips (Changguang Chenxin) and industrial lenses (Long Trail Optoelectronics) through industrial investment, and independently develops characteristic cameras, special cameras, characteristic exclusive light sources, and image acquisition cards. Tianzhun Technology independently develops 3D visual sensors (linear excitation light sensors), precision drive controllers, and other upstream components of visual equipment.

Companies with deeper accumulation in core technologies such as optical imaging, software algorithms, automation, and precision control related to machine vision have a stronger competitive advantage in the development pattern of intensified competition and mutual penetration between upstream and downstream. Top domestic machine vision manufacturers have already possessed full industry chain technology comparable to overseas leaders.

3.3.2 Horizontal: Expanding product categories around machine vision technology

Integrating machine vision technology with production and manufacturing processes, and launching intelligent production and manufacturing equipment.

Tianzhun Technology applies machine vision related software algorithm technology to the exposure process in PCB production, and introduces LDI laser direct imaging equipment with higher imaging quality, production capacity, and alignment accuracy. The product was launched at the end of 2020 and achieved sales of 70 million in 2021. Juzi Technology combines machine vision detection with dispensing production to launch a high-speed dispensing equipment that integrates production and quality inspection, achieving good market feedback.

Continuously expanding the variety of machine vision products to meet the changing demands of downstream applications is a necessary path for the development of midstream manufacturers, and intelligent production and manufacturing equipment with machine vision "genes" is bringing new growth points for machine vision equipment manufacturers.

3.3 Downstream: The application scenarios are gradually expanding, and the demand for key tracks is increasing rapidly

With the gradual transformation and upgrading of China's manufacturing industry, the downstream application track of China's machine vision industry is gradually expanding.

In the early days of our country, machine vision was mainly applied in the three major industries of consumer electronics, semiconductors, and automobiles. These industries as a whole have high requirements for equipment accuracy, accuracy, and stability. In recent years, with the overall transformation and upgrading of China's manufacturing industry towards intelligence and automation, machine vision technology and related equipment have been able to penetrate into more downstream application industries, such as batteries and robots.

The key new tracks represented by lithium batteries are worth paying attention to.

From the perspective of downstream application industry growth rate, the lithium battery and new energy vehicle industries achieved the fastest growth rate in 2021, with growth rates of 181% and 150% respectively. The rapid development of downstream application industries and the gradual increase in penetration rate of industrial machine vision in production lines have brought about a high demand for industrial machine vision, with demand growth rates in the lithium battery and new energy vehicle industries reaching 30% and 25% respectively.

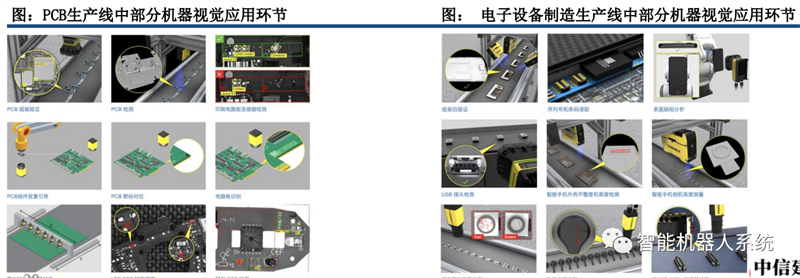

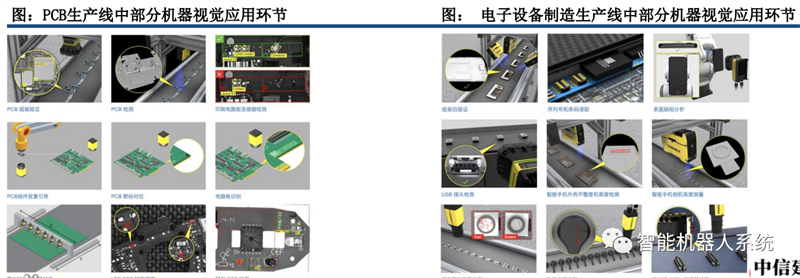

3.3.1 3C Electronics: High quality standards bring high penetration rate of machine vision

Machine vision is widely used in the 3C electronics industry.

The 3C electronics industry has the characteristics of small component sizes and high quality standards, therefore there is a high demand for machine vision. At present, machine vision is applied in multiple stages of PCB and 3C electronic production lines. Future machine vision technology is expected to penetrate into more aspects of PCB production and manufacturing. Machine vision is a crucial tool for PCB alignment, SMT picking, placement and installation verification, and solder paste verification applications.

With the continuous maturity of 3DAOI products, machine vision products will open up more application scenarios in the manufacturing process of electronic finished equipment. Machine vision solutions are applied to display defect detection, product shell defect detection, axis and disc assembly/magnetic head suspension component robot guidance, optical character recognition and other links.

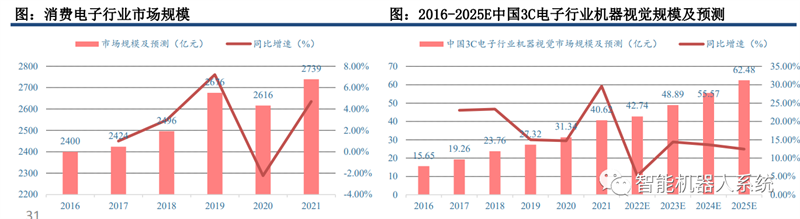

3.3.2 3C Electronics: Product and production line upgrades and iterations bring stable growth

The continuous iteration and upgrading of the product bring stable demand.

With the upgrading of 3C electronic products, the precision of products is gradually improving, and the precision requirements in the production and manufacturing process are also gradually increasing, promoting further penetration of machine vision. Meanwhile, due to the short overall lifecycle of consumer electronics products, the iteration of new products such as foldable screens and 5G smartphones has led manufacturing companies to continuously update their production lines, thereby creating stable demand for machine vision enterprises.

The consumer electronics production line has been further upgraded and iterated.

With the gradual development of 3C electronic products, electronic product manufacturers are also gradually iterating production quality standards. For example, in the mobile phone production process, Apple's production process and process standards are the highest. However, with the intensification of market competition, major Android phone manufacturers are also gradually promoting production quality analysis and upgrading and iteration of production lines, which is expected to bring about an expansion of machine vision demand.

In the coming years, although the overall growth rate of the 3C electronics industry market will slow down, the demand for machine vision in the 3C electronics industry will continue to steadily increase. At the same time, domestic manufacturers with gradually matured technology are expected to gain a larger market share. Overall, 3C electronics remains an important downstream application scenario in machine vision.

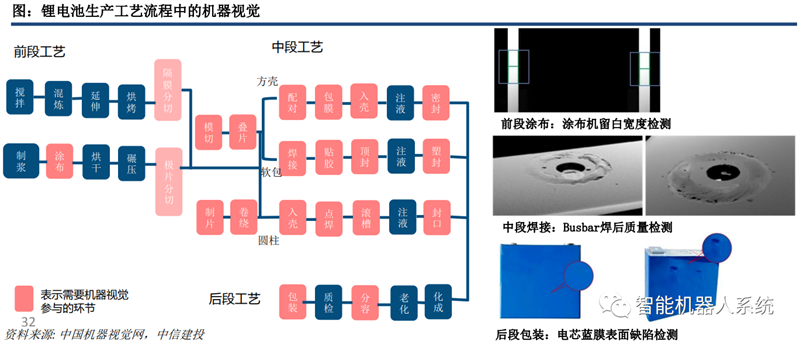

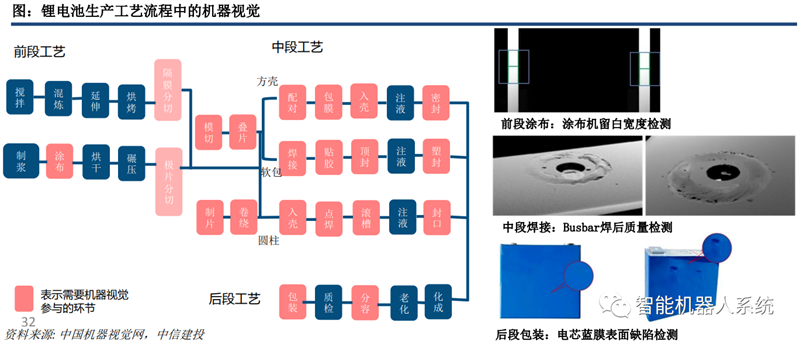

3.3.3 Lithium batteries: machine vision gradually penetrates

The penetration rate of machine vision in the lithium battery industry is gradually increasing:

With the improvement of intelligence and automation in lithium battery manufacturing, machine vision products are widely used in various stages of lithium battery equipment production. The penetration rate of machine vision applications is gradually increasing, from the coating and rolling process in the early stage, to the assembly of battery cells in the middle stage, and then to the detection of chemical composition after the later stage, as well as the module PACK section.

3.3.4 Lithium batteries: Clear quality control requirements and excellent competitive landscape

Clear quality control requirements.

In the early stages of expanding production in the lithium battery industry, quality control was often less considered, but as the industry gradually shifted from high-speed development to high-quality development and users had higher demands for lithium battery safety. Machine vision has become an inevitable choice for lithium battery production enterprises to solve quality and efficiency problems. According to GGJ's prediction, the market size of lithium battery machine vision detection systems will maintain rapid growth, with a compound annual growth rate of 40% in the next five years.

Excellent competitive landscape.

In the field of machine vision in industries such as 3C electronics and automobiles, overseas giants have stronger technological accumulation and long-term cooperative relationships, which pose certain obstacles to the market expansion of Chinese machine vision enterprises. However, the lithium battery industry is an emerging industry that has developed in China in recent years. As a result, lithium battery enterprises and Chinese machine vision enterprises have cooperated and developed, resulting in a high degree of localization.

The overall growth rate of the lithium battery industry is relatively fast, and machine vision in lithium batteries has the advantages of high industry growth rate, clear demand, and excellent competitive landscape. It is expected to maintain high growth rate in the next two to three years, making it the most promising downstream application market.

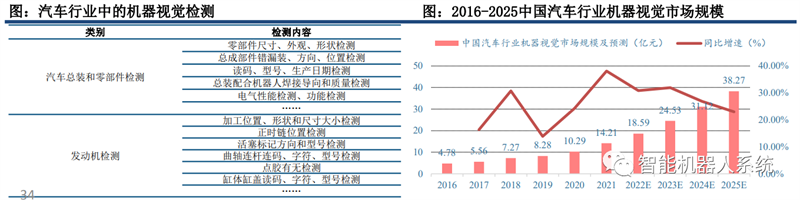

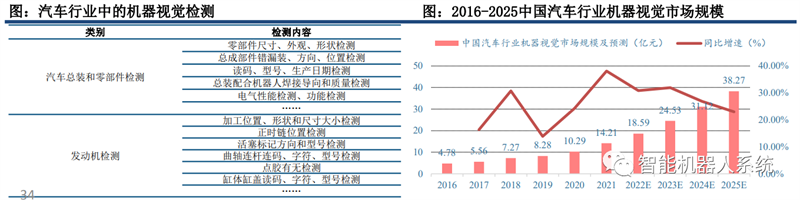

3.3.5 Automobile: With a high degree of production and manufacturing automation, the demand for machine vision continues to increase

The automation level of the automobile manufacturing process is high, and machine vision is widely used.

The safety and efficiency in the automobile manufacturing process are the primary goals of automobile production enterprises, so the entry threshold for main engine factories is high, and the production line has basically achieved automation. At present, machine vision products are applied in automotive assembly, component inspection, engine inspection, and other processes. According to the investigation, currently one production line is equipped with more than ten machine vision systems.

The gradual upgrading of automobile production lines has brought about a dual increase in the demand and requirements for machine vision.

On the one hand, the demand for automotive production line control continues to increase. On the other hand, with the development of new energy and autonomous driving, precision electronic components such as radar, sensors, communication devices, and cameras will be loaded onto cars. These two factors drive the continuous improvement of precision and intelligence requirements in the automotive production process, bringing new development opportunities for machine vision enterprises. However, due to the stable cooperation between traditional automobile manufacturers and foreign machine vision leaders, as well as the high cost of supplier replacement, the opportunities for Chinese machine vision enterprises in the automotive industry mainly lie with newly emerging new energy manufacturers.

The automotive industry is a very mature and promising industry for machine vision applications. In the short term, the collaborative development between domestic and emerging automotive manufacturers will open up huge market space if traditional automotive manufacturers can be replaced by overseas manufacturers in the long term.

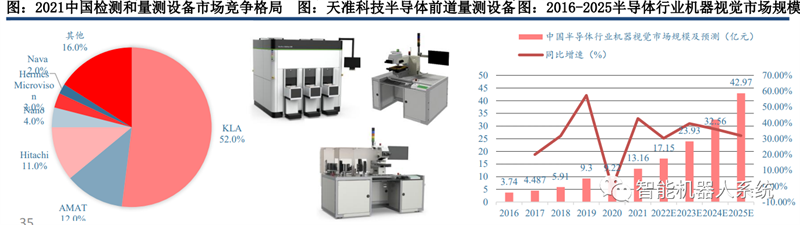

3.3.6 Semiconductor: Machine vision applications are relatively mature, and overseas giants occupy the high-end market

The semiconductor industry has a clear demand for machine vision and its applications are relatively mature and widespread.

The semiconductor industry has the characteristics of high integration and precision, and the detection role that human vision can play is quite limited. The demand for machine vision is clear. Based on this characteristic, the semiconductor industry is one of the earliest and large-scale downstream fields of machine vision technology, covering the detection of semiconductor appearance defects, size, quantity, flatness, distance, positioning, calibration, solder quality, bending, etc. The entire process of detection, positioning, cutting, and packaging in wafer manufacturing requires the assistance of machine vision technology.

High end semiconductor testing equipment is mainly occupied by overseas giants.

Due to the first mover advantage of overseas giants in the field of semiconductor testing, the high-end market in semiconductor machine vision is currently mainly occupied by overseas leaders. Meanwhile, due to the high production requirements of the semi early body industry, domestic machine vision manufacturers often find it difficult to directly enter this field.

Domestic manufacturers have made breakthroughs in certain products, such as precision electronic film thickness measurement equipment, critical dimension measurement equipment, electron beam defect re examination equipment, graphic crystal ring defect detection equipment, Zhongke Feice's graphic and non graphic circular defect detection equipment, film thickness measurement equipment, and three-dimensional morphology measurement equipment, all of which have obtained orders or been verified on customer production lines. High end semiconductor testing is a high-end technology that China needs to focus on breakthroughs.

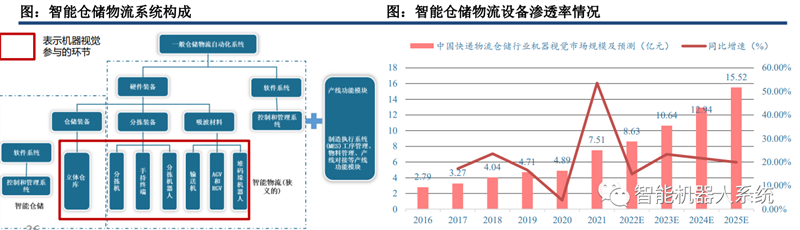

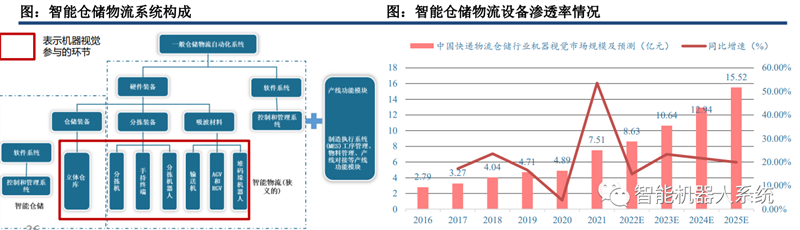

3.3.7 Warehousing and logistics: Clear demand for cost reduction and efficiency improvement, and vast market space for intelligence

The demand for cost reduction and efficiency improvement in the warehousing and logistics industry is clear.

The typical application scenarios of machine vision in the warehousing and logistics industry are palletizing and rapid sorting, which includes visual guidance equipment for identifying and positioning multi SKU goods, guiding robots to grasp and place them, and visual recognition equipment for quickly scanning and identifying product information such as QR codes. The overall labor and equipment costs and gross profit margin of the logistics and warehousing industry are relatively low, and there is a higher demand for the cost-effectiveness of machine vision solutions.

The market space for intelligent warehousing and logistics equipment is vast.

At present, the intelligent warehousing and logistics industry in China is still in its early stages, and the overall penetration rate of intelligent devices is relatively low. However, with the increase in labor costs caused by changes in population structure and the rapid development of e-commerce logistics and warehousing application scenarios, intelligent warehousing and logistics systems are still an inevitable trend for future industry development. Machine vision, which plays an important role in multiple aspects of intelligent warehousing and logistics, is also expected to achieve good development. The warehousing and logistics industry is driven by the demand for cost reduction and efficiency improvement in the short term, and the demand for digitization and intelligence in the long term. The penetration rate of machine vision is expected to increase.

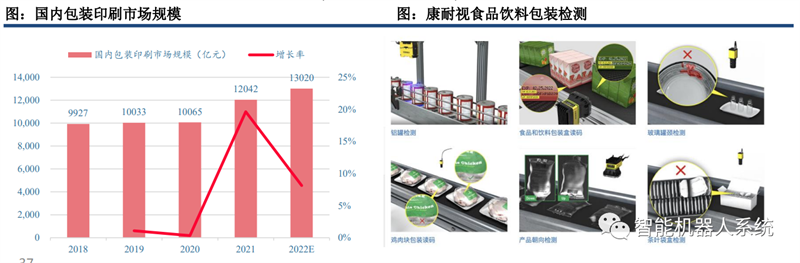

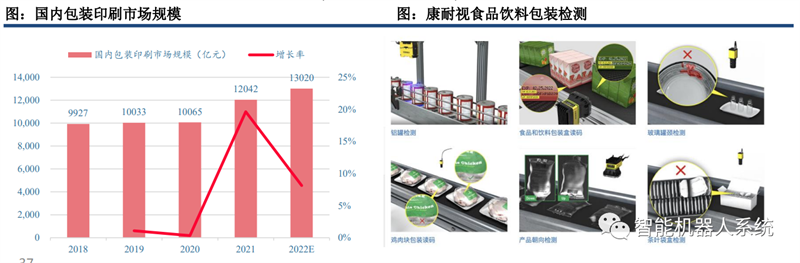

3.3.8 Packaging and Printing: There is an opportunity for domestic substitution, and the recovery of consumer scenarios drives demand recovery

The printing and packaging production line heavily relies on machine vision inspection, and there is an opportunity for domestic substitution.

Machine vision is involved in measuring the volume of packaging materials, reading packaging barcodes, and detecting packaging sealing defects in the packaging and printing industry, with an overall penetration rate of high. However, due to the early development of China's printing and packaging industry, cooperation relationships were initially established with overseas merchants, and there is still some room for domestic substitution.

The demand for machine vision in the printing and packaging industry is expected to recover in the post pandemic era.

With the gradual activation of consumer scenarios in the post pandemic era. The production capacity of consumer goods such as food, beverages, and pharmaceuticals is expected to be further released, and it is expected that the packaging and printing industry will recover, thereby driving the demand for machine vision. The application demand of machine vision in the printing and packaging industry is relatively stable, and there is room for domestic substitution. It is optimistic that the rebound in consumption will drive overall industry demand growth.

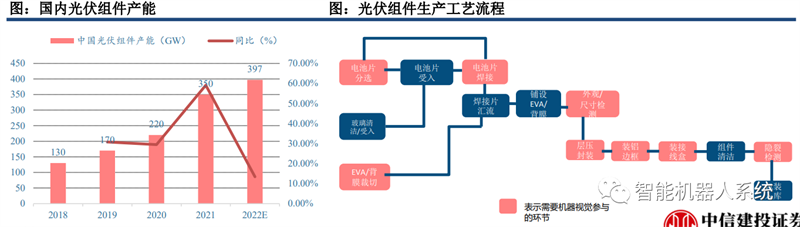

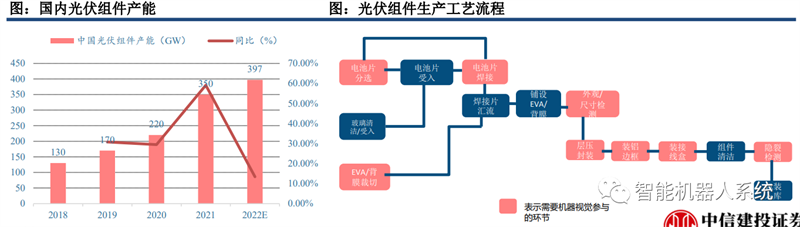

3.3.9 Photovoltaics: Deep involvement of machine vision, embedded/configurable systems expected to be promoted

Machine vision devices are deeply involved in the production process of photovoltaic modules.

At present, machine vision equipment is applied in the cell sorting, EVA/back film cutting, cell welding, appearance/size inspection, packaging, aluminum frame/junction box installation, and hidden crack detection processes in photovoltaic module production. With the increase in downstream photovoltaic installation and stimulation of production capacity release, photovoltaic manufacturers will inevitably upgrade or purchase new manufacturing and testing automation equipment to improve the production efficiency and product competitiveness of their production lines.

The characteristics of the production line determine that embedded/configurable visual systems have better application prospects.

The layout of photovoltaic production lines is relatively compact, and the process street connection is more mature. Embedded or configurable visual systems are expected to be widely used in the field of photovoltaic modules because they can minimize the modification of existing production lines as much as possible.

Machine vision has a high penetration rate and mature application in the photovoltaic industry, but the short-term slowdown in the growth rate of the photovoltaic industry has led to a relative slowdown in industry growth. In the future, the importance of clean energy and the improvement of cost-effectiveness will bring certain growth space.

Analysis of 04 Machine Vision Overseas Leading Enterprises

4.1 Keyence: Based on optoelectronic sensing technology, a leading comprehensive supplier of industrial automation products

Founded in 1974, Keens is a leading international comprehensive supplier of sensors, measurement systems, laser engraving machines, microscopy systems, and standalone imaging systems, produced using the Fabless model.

Based on the core technology of optoelectronic sensing, we continuously launch globally leading machine vision products.

The company's products have gradually evolved from automated sensors and measuring instruments to machine vision systems and equipment such as laser marking machines, image measurement processing systems, and 2D/3D laser scanners. Keens has become a global leader in sensing devices through continuous research and development. Our products cover multiple fields of industrial manufacturing and scientific research, serving over 200.000 customers in approximately 70 countries worldwide. Ranked 17th on Forbes' list of the world's most innovative companies.

4.1.1 Keyence: Provides a wide range of industrial automation products, with full coverage of machine vision core processes

The company provides a wide range of industrial automation products.

The company's products include visual systems and equipment, microsystems, industrial measurement systems, PLC and engraving equipment, etc., which are designed for general purposes and can be applied in various industries.

The company achieves full coverage of the core links of machine vision.

The company's independent machine vision products cover LED light sources and light source controllers, machine vision cameras, lenses, and software algorithms. On the one hand, they enable better flexible use of components, thereby better meeting the different needs of different customers. On the other hand, they greatly strengthen the product series group, thereby maximizing the image processing capabilities of the company's products. At the same time, it also builds a high "industrial moat" for the company, which is conducive to maintaining its market position.

4.1.2 Keyence: Provides a wide range of industrial automation products, with full coverage of machine vision core processes

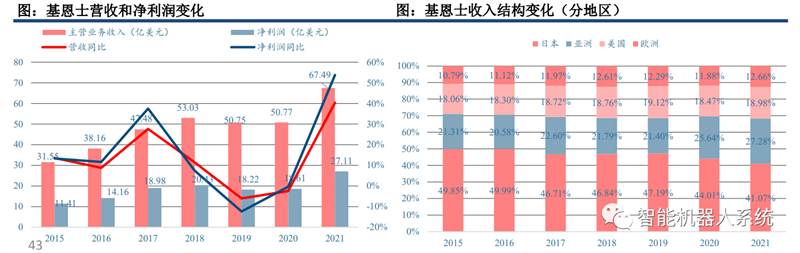

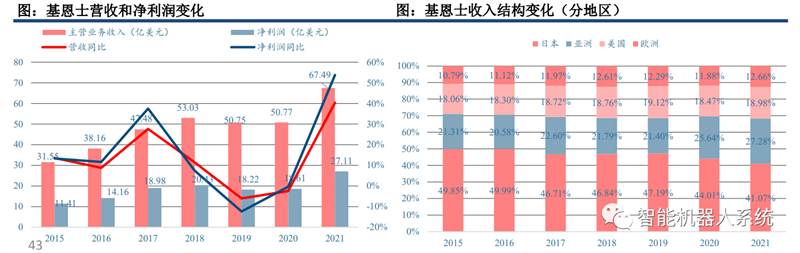

4.1.3 Keyence: In recent years, the company's revenue has grown rapidly and its overseas business has continued to expand

Since 2021, the company's revenue has grown rapidly and its profitability has improved

In the fiscal year 2021, the company's main operating revenue was 6.749 billion US dollars, a year-on-year increase of 40.33%. The net profit was 2.711 billion US dollars, a year-on-year increase of 53.76%, higher than the year-on-year growth rate of revenue, reflecting the high increase in revenue while also improving the company's profitability.

Overseas business drives growth:

In the 2021 fiscal year, Keinz's sales revenue in Japan was 2.772 billion US dollars, a year-on-year increase of 30.9%; Overseas sales amounted to 3.977 billion US dollars, a year-on-year increase of 47.7%. China has the fastest regional growth rate, achieving a revenue of 1.149 billion US dollars, reaching 49.2% compared to the same period.

Keinz has promoted its independent experience in developing customers in Japan to overseas Asia, resulting in significant business growth:

With the gradual expansion of the company's sales team into overseas markets and the accelerated transformation and upgrading of the manufacturing industry in overseas markets, the proportion of the company's domestic business in Japan from 2019 to 2021 was 47.19%/44.01%/41.07%, and the proportion of the company's overseas business was 52.81%/55.99%/58.93%, respectively, showing an upward trend.

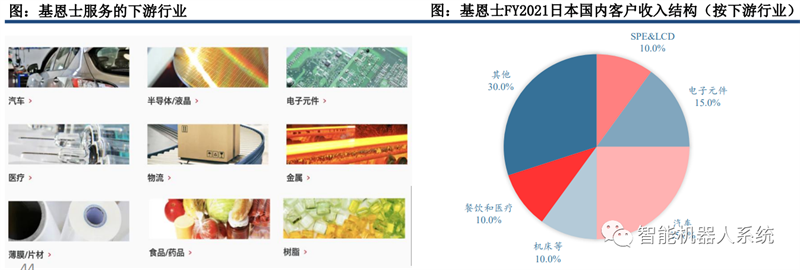

4.1.4 Keyence: Provide solutions for a wide range of downstream industries, with a balanced proportion of each downstream

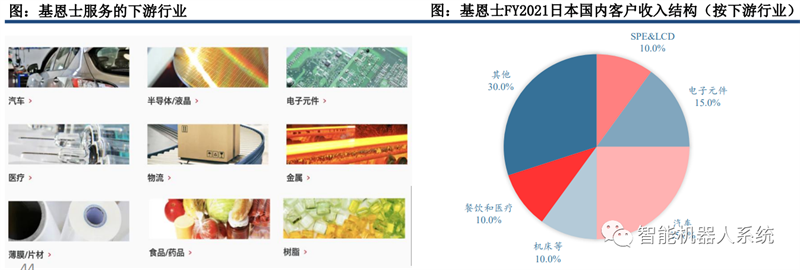

The company provides rich solutions for a wide range of downstream industries:

Keinz's product applications cover a wide range of downstream industries, including automobiles, semiconductors/LCDs, electronic components, healthcare, logistics, metals, thin films/sheets, food/pharmaceuticals, resins, and more. At the same time, we provide rich solutions within a single downstream industry. Taking the electronic components industry as an example, Keen Shi can achieve functions such as wafer positioning/PCB version positioning/crystal oscillator defect detection/carp battery defect detection.

The revenue distribution in the downstream application industry of the company is relatively balanced:

In the second half of the 2021 fiscal year, Keinz Japan's domestic customers were divided by downstream industries into SPE&LCD 10%, electronic components 15%, automobiles 25%, machine tools and other mechanical equipment 10%, catering and medical 10%, and other 30%. The overall revenue structure is relatively balanced, and the dependence on a single downstream industry is weak, which is conducive to the company's sustained and stable development.

4.1.5 Keyence: Global marketing network layout, direct sales model to better meet and explore customer needs

The company has achieved a global layout of its marketing network:

At present, Keyence has 230 offices in 46 countries and regions, forming an efficient global branch network, providing solutions to improve the quality and efficiency of automated manufacturing for Fortune 500 manufacturing enterprises and even small suppliers worldwide.

The company adopts a direct sales model to better meet customer needs:

Compared to traditional distribution models, the company adopts a direct sales model to directly contact customers. On the one hand, to provide customers with better product related information and services with higher efficiency, including on-site manufacturing and automation knowledge, model selection, on-site operation guidance, precautions after product adoption, and after-sales service. On the other hand, it enables deep collaboration with customers, based on their industry knowledge in relevant scenarios, to explore and develop products tailored to their potential needs, and continuously launch machine vision products that meet the world's leading standards.

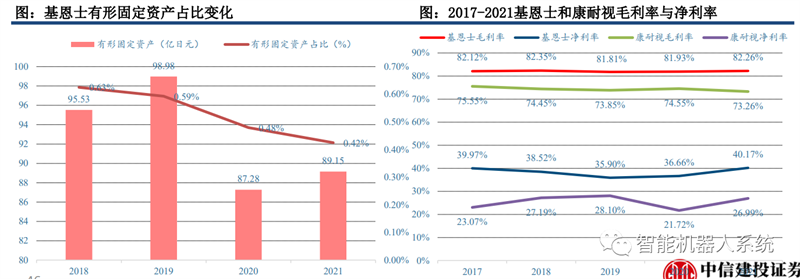

4.1.6 Keyence: Leading global product strength shaping profit margins

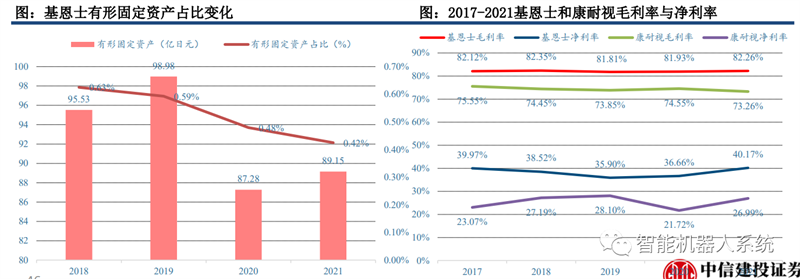

The company adopts the Fabless business model:

The company focuses on the design and development of sensors, automation equipment, and other components with the highest profit margins, outsourcing production related businesses to professional manufacturers. During the fiscal year 2018 to 2021, the proportion of tangible fixed assets of the company to total assets was only 0.63%/0.59%/0.48%/0.42%.

Leading global standardized products help the company maintain a high level of gross profit margin/net profit margin: from fiscal year 2017 to fiscal year 2021, the company's gross profit margin remained stable at over 80%, while the net profit margin fluctuated around 38% overall, demonstrating a globally leading product capability. The complete layout of the core components of machine vision has enabled Shinji to demonstrate stronger profitability compared to the entire industry.

4.2.1 Cognex: Global Leader in Machine Vision and Code Reading

Cognex was founded in 1981.

We are an advanced provider of visual systems, visual software, visual sensors, and industrial code readers for the field of manufacturing automation. Cognex focuses on machine vision technology and provides different automation equipment for the manufacturing industry.

Cognex stands for "cognition experts" and has been committed to the application of machine vision in the manufacturing industry since its early development. The company's early machine vision product, the DataMan vision system, was the world's first industrial optical character recognition (OCR) system capable of reading, verifying, and confirming letters, numbers, and symbols directly marked on parts and components.

In the subsequent development process, Cognex has gradually improved its industrial chain layout through independent research and development, mergers and acquisitions, and other means. On the one hand, it has developed independent industrial machine vision cameras, and on the other hand, it has expanded its product matrix in its own machine vision products, further covering automation equipment, electronic products, automobiles and other fields from the application industry, and covering the low, medium, and high-end markets in product positioning.

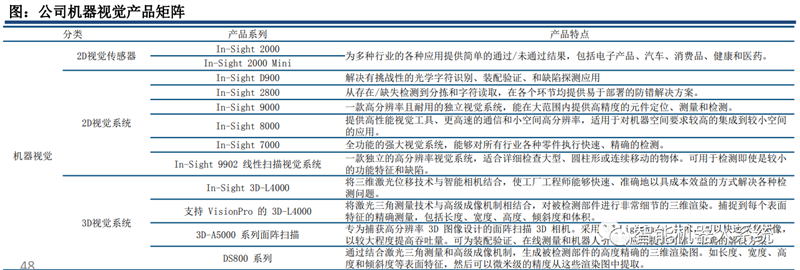

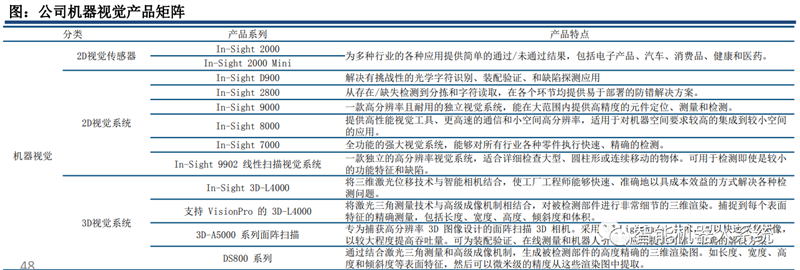

4.2.2 Cognex: Provides a wide range of machine vision products, with independent coverage of camera and software links

Cognex offers a wide range of machine vision and code reader products.

The company's products are mainly divided into two parts: machine vision and code readers. The machine vision part is divided into 2D vision sensors, 2D vision systems, and 3D vision systems, achieving coverage for enriching downstream application fields and different detection objects, tasks, and performance requirements. Code readers include fixed code readers, handheld code readers, barcode validators, etc.

Cognex has achieved autonomous coverage of camera and software, which are important components in machine vision.

The company has industry-leading machine vision software systems VisionPro (3D) and In Sight Vision Suite (2D). At the same time, the company provides industrial cameras (CIC), image boards, I/O cards, and visual controller visual accessories, which can be easily integrated with the company's software to establish solutions that meet the application needs of different industries.

4.2.3 Cognex: Revenue has declined and the proportion of Chinese business has increased

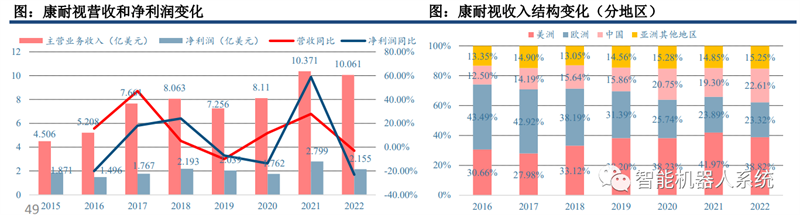

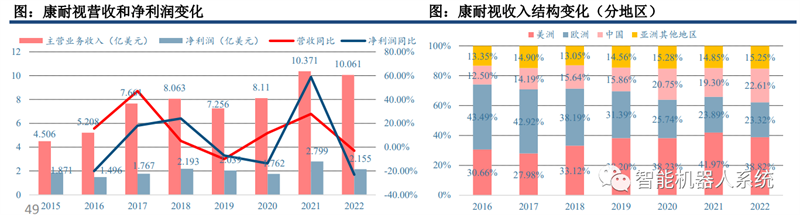

Revenue slightly declined in 2022:

In 2022, the company achieved a revenue of 1.0061 billion yuan, a year-on-year decrease of 2.99%, and a net profit attributable to the parent company of 215.5 million yuan, a year-on-year decrease of 23.01%. The fire that occurred at the supplier's factory in Indonesia overall affected the company's completion of related orders. In specific industries, the slowdown in project progress of large e-commerce customers in the logistics industry, which accounted for the highest proportion in 2021, led to a 25% decrease in revenue in the logistics industry. The consumer electronics and automotive industries achieved revenue growth of about 8% and 7% respectively, partially offsetting the impact of the logistics industry downturn

The growth rate of the company's revenue slowed down from 2017 to 2020:

The year-on-year growth rates were 47.10%/5.25%/-10.01%/11.77%, respectively. In 2021, thanks to the rise of e-commerce, the development of the automobile field towards electric vehicles, labor shortage, increased requirements for product traceability, and the accelerated development of "no touch" bar code reading in the COVID-19, an increase of 28% will be achieved.

The proportion of Chinese business has increased but the growth rate has slowed down:

Although the overall revenue growth rate of the company has declined, the growth rate of business in other regions is slower compared to that in China. Therefore, the proportion of business in China has increased from 12% in 2016 to 22% in 2022. However, in recent years, the relevant growth rates have also shown a slowing trend, with revenue growth rates in China in 2020/2021/2022 being 46%/19%/13%, respectively. Among other regional businesses, the contraction of European business is the most significant, decreasing from 43% in 2016 to 23% in 2022. The business in the Americas continued to expand between 2016 and 2021, reaching 42% in 2021, but decreased slightly to 38.82% in 2022

4.2.4 Cognex: The automotive/consumer electronics business has shrunk, and logistics has become the main downstream application scenario

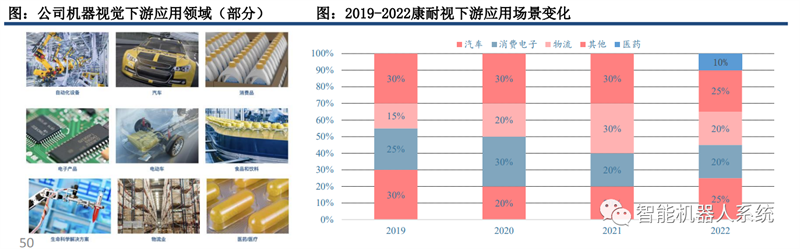

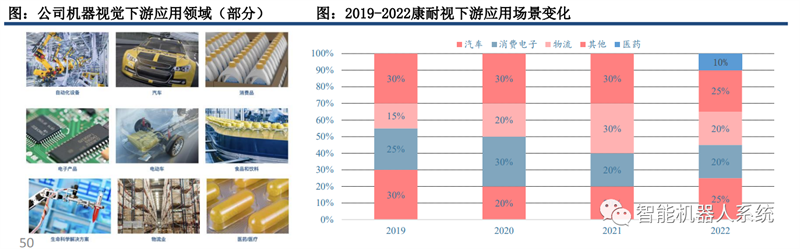

Downstream application scenarios are extensive, with automotive/consumer electronics/logistics as the main application scenarios:

Cognex provides standardized products that are applied in a wide range of downstream scenarios, including automation equipment, automobiles, consumer goods, electronics, food and beverage, logistics, etc. Among them, automobiles, consumer electronics, and logistics are the main downstream application scenarios of Cognex, accounting for a total of 70% (in 2021). In 2022, the growth rate of pharmaceutical related businesses was relatively fast, making it the fourth largest application scenario in the overall business, accounting for 10%.

The automotive consumer electronics business is shrinking, and logistics scenarios have become the main downstream application scenarios:

As domestic manufacturers gradually mature their technology and achieve domestic substitution in the Apple industry chain, the company's consumer electronics business has shrunk, from 25% in 2019 to 20% in 2021. At the same time, the automotive business has shown a significant contraction trend, from 30% to 20%. With the development of e-commerce industry and the transformation of logistics industry brought by COVID-19, the proportion of logistics industry shows an upward trend, from 15% to 30%, which is the highest proportion in the downstream scene. In 2022, due to factory fires in Indonesia, logistics business significantly declined, and the proportion of other businesses increased accordingly. If the impact of fires is removed, the overall business pattern has not changed significantly.

Report source: CITIC Construction Investment

Report Editor: Intelligent Robot Systems

Note: * This article (including images) is a reprint. If there is any infringement, please contact us to delete it.